About the Resources and Energy Quarterly

The Resources and Energy Quarterly contains the Office of the Chief Economist’s forecasts for the value, volume and price of Australia’s major resources and energy commodity exports. A ‘medium term’ (five year) outlook for Australia’s major resource and energy commodity exports is published in the March quarter edition of the Resources and Energy Quarterly. The June, September and December editions contain a ‘short term’ (two year) outlook.

Underpinning the forecasts contained in Resources and Energy Quarterly is the Office of the Chief Economist’s outlook for global commodity prices, demand and supply. The forecasts for Australia’s commodity exporters are reconciled with this global context. The global environment in which Australia’s producers compete can change rapidly. Each edition of Resources and Energy Quarterly factors in these changes, and makes appropriate alterations to the outlook, estimating the impact on Australian producers and the value of their exports.

Foreword

Australia’s resource and energy export earnings are estimated at $405 billion in 2021–22, and forecast to rise to $419 billion in 2022–23, delivering two successive record years. As world supply responds to high prices and commodity demand moderates, earnings are forecast to fall below $338 billion in 2023–24, still the third highest ever.

Driving the sharp surge in energy and base metal prices has been a post-COVID recovery in demand, production disruptions and the impact of the potential loss and diversion of some Russian exports from markets. Coming on top of already low inventories for many commodities, the bullish demand and supply factors have pushed many commodity prices to new records. Unfortunately, this has exacerbated price pressures in other areas of economic activity. With the economic impacts of the COVID-19 pandemic now beginning to wane over the projection period, central banks are now tightening monetary policies.

Western developed nations have imposed further sanctions on Russia, the latest being a European Union ban on seaborne oil and oil product imports from Russia. This means about 90% of Russia’s oil exports to the 27-nation bloc will end in 2022. Some of the oil and other fossil fuels that Russian normally exports to Western countries is being diverted to nations such as China and India, but transport and infrastructure constraints will likely prevent a full diversion.

In recent months, China has relaxed macroeconomic policy further, in order to support economic growth. The Chinese economy has been impacted by COVID-19 lockdowns in some major cities, and the authorities are likely to take further measures to strive to achieve the 2022 growth target of 5.5%.

The La Niña weather pattern has ended for now, however there are now forecasts of a strongly negative Indian Ocean Dipole reading. This could see wet weather continue in Australia in the second half of 2022, with further risks of an adverse supply impact on Australian thermal and metallurgical coal. With energy stocks in the Northern Hemisphere well below normal, any supply disruptions will result in more price surges.

The OECD forecasts world GDP growth of 3.0% in 2022 and 2.8% in 2023. China’s GDP is forecast to grow by 4.4% in 2022, rising to 4.9% in 2023. Hopefully, the rise in inflation in most major economies will peak over coming months, with inflation gradually settling back over the next 12-18 months as central banks navigate the challenge of managing inflation containment with ongoing growth in GDP and employment.

Since the March 2022 Resources and Energy Quarterly, gas/LNG and coal prices have been pushed to record highs. The outlook is for the prices of these commodities to remain strong for longer than previously forecast, as Western nations look for alternatives to Russian energy supplies. However, while these high prices will persist for longer, they are likely to further accelerate the push towards renewable energy in the medium-term.

Australian iron ore earnings are forecast to decline further from the extraordinary levels seen in 2020–21 and 2021–22. The price has steadied in a US$110-140 a tonne range in recent months, as China’s government continues to support economic activity. However, the ongoing recovery in Brazilian supply, and gains in output elsewhere, are set to push iron ore prices down over the outlook period.

Global efforts to build energy and transport systems based on lower emission sources are expected to keep (base and critical) metal prices strong. This will partly offset the impact of energy exports coming off their highs, as world trade in fossil fuels re-organises.

The risks to the forecast for Australia’s export earnings in 2022–23 and 2023–24 are skewed modestly to the downside. Markets appear to have largely priced in the loss of some Russian resource and energy commodity output from world supply. New outbreaks of vaccine-resistant COVID-19 strains also pose risks to the outlook, especially if they occur in China where small outbreaks are currently being met with aggressive suppression measures: through direct impacts on global commodity demand, and via global supply chains and economic growth.

Overview

Australia’s resource and energy export earnings are forecast reach a new record in 2022–23

- The outlook for Australia’s mineral exports remains strong, as energy shortages persist and the world economy rebounds from the impact of the COVID-19 pandemic. High prices, volume gains and a weak Australian dollar, are driving a surge in export earnings. Some decline in prices is likely in 2023, as supply rises at the same time that demand growth moderates.

- Export earnings are estimated to have lifted by almost $100 billion to a record $405 billion in 2021–22, and are forecast to rise to $419 billion in 2022–23. Earnings should fall back below $338 billion in 2023–24.

- Energy prices have jumped, on the prospect that the fallout from Russian invasion of Ukraine will intensify energy shortages. Commodity prices should settle back in 2023, as inventories rebuild and as world trade re-organises.

Macroeconomic outlook

The pace of the global recovery continues to slow

- The global macroeconomic environment is currently subject to an unusually high level of uncertainty. The confluence of supply shocks, slowing global growth and elevated inflation, is providing substantial policy challenges for governments across most major economies.

- The world economy is forecast by the OECD to grow by 3.0% in 2022 — a downward revision of 1.5 percentage points from the end of last year — and 2.8 per cent in 2023.

- The fallout from Russia’s invasion of Ukraine and stringent lockdowns in China is slowing growth and adding to supply chain bottlenecks. These twin shocks are weighing heavily on markets as inflationary pressures mount, and monetary policy is being tightened.

Steel

Steel output in 2022 facing weakened demand, and supply disruptions

- World steel production is now forecast to grow by 0.6% in 2022 — a significant (1.6 percentage point) downward revision from the March 2022 Resources and Energy Quarterly (REQ). This follows recent outbreaks of the COVID-19 pandemic in China, as well as impacts to major steel markets and global supply chains from current energy shortages and Russia’s invasion of Ukraine.

- Global construction activity is expected to drive modest growth in world steel demand in 2022, with large infrastructure rollouts, and rising non-residential construction. However, this will be partially offset by further cuts to global auto production and subdued residential construction.

- Over the outlook period, global steel output is expected to grow by 1.3% in 2023 and by 1.1% in 2024. China is expected to record lower steel output (as part of its aim for peak steel), the EU/Japan to stay at current levels, and India/Brazil to see annual growth of 4-6% to 2024.

Iron ore

Iron ore prices maintain 2022 rebound in the June quarter

- Iron ore prices have remained relatively stable in the June quarter 2022, and are expected to average around US$130 a tonne (CFR).

- While China is still expected to ramp up infrastructure-related construction activity (raising its steel and iron ore demand) in 2022, recent outbreaks of the COVID-19 pandemic are delaying this upswing.

- Australian export volumes are estimated to have grown (by 8 million tonnes) to 876 million tonnes in 2021–22, with new supply coming online. Exports are forecast to rise to 929 million tonnes by 2023–24.

- Australia's iron ore export earnings are projected to ease from $133 billion in 2021–22 to $116 billion in 2022–23, and fall to $85 billion by 2023–24. This reflects moderating prices expected over the outlook.

Metallurgical coal

Metallurgical coal export earnings have lifted strongly in recent months

- Metallurgical coal prices remain at historic highs, pushed up by supply disruptions and market uncertainties as a result of the fallout from the Russian invasion of Ukraine. The Australian premium hard coking coal price is forecast to average over US$420 a tonne in 2022, but is expected to fall by almost half as supply conditions normalise. Prices are ultimately expected to reach around US$220 a tonne by 2024.

- Higher production in NSW and Queensland is expected to push Australia’s exports up from 171 million tonnes in 2020–21 to 174 million tonnes by 2023–24.

- Australia’s metallurgical coal export values are forecast to track with price movements, rebounding from $23 billion in 2020–21 to peak above $60 billion in 2022–23, before falling back to $41 billion by 2023–24.

Thermal coal

Australia’s thermal coal export earnings have risen as global supply disruptions intensify.

- Thermal coal prices remain elevated, driven by weather and COVID-19 workforce disruptions, and by market uncertainties linked to fallout from the Russian invasion of Ukraine. As more normal conditions return, the Newcastle benchmark price is forecast to ease from a peak of US$280 a tonne in 2022, to average around US$115 a tonne in 2024.

- A resolution of recent supply disruptions is expected to see Australian thermal coal exports increase from 192 million tonnes in 2020–21 to 207 million tonnes by the end of the forecast period.

- Record prices are expected to see export values peak at $38 billion in 2021–22, with a gradual (price-driven) easing to around $31 billion by 2023–24.

Gas

Australia’s LNG export earnings to rebound strongly in 2021–22, as prices recover

- Asian LNG spot prices and oil-linked contract prices are expected to remain high over the two-year outlook.

- Australian export volumes are forecast to increase to 82 million tonnes in 2021–22, as technical issues offset higher capacity utilisation at other plants. Volumes should then fluctuate between 79 and 81 million tonnes over the outlook.

- Australia’s LNG exports earnings are estimated to have doubled from $30 billion in 2020–21 to $70 billion in 2021–22. They are forecast to reach $84 billion in 2022–23, as oil-linked contract prices and Asian LNG spot prices surge. Export earnings are forecast return to around $68 billion by the end of the outlook period.

Oil

Australian crude and condensate export earnings to lift significantly with higher prices

- Significant uncertainty surrounds global oil markets, with the fallout of Russia’s invasion of Ukraine dominating global supply concerns and COVID-19 outbreaks in China weakening global demand prospects. Brent crude oil is forecast to average US$105 a barrel in 2022, before declining over the rest of the forecast period.

- Australian crude oil and feedstock exports in 2021–22 are estimated to have averaged 282,000 barrels a day, and are forecast to hold steady out to 2023–24.

- Elevated oil prices are estimated to have lifted Australian oil export earnings by 81% to $13.5 billion in 2021–22. Earnings are forecast to reach $14.3 billion in 2022–23 before returning to $12.6 billion in 2023–24, as oil prices fall from current highs.

Uranium

Uranium prices are rising, with volumes also set to grow.

- Uranium prices are forecast to lift from US$53 a pound in 2022 to US$61 a pound by 2024. Uranium shortfalls are becoming a prospect, following years of low prices and underinvestment.

- Australian exports are forecast to decline to 4,700 tonnes in 2021–22, following the closure of the Ranger mine. This is expected to rise to around 5,500 tonnes by 2023–24.

- Price growth is expected to increase uranium export values from $514 million in 2021–22 to $815 million by 2023–24.

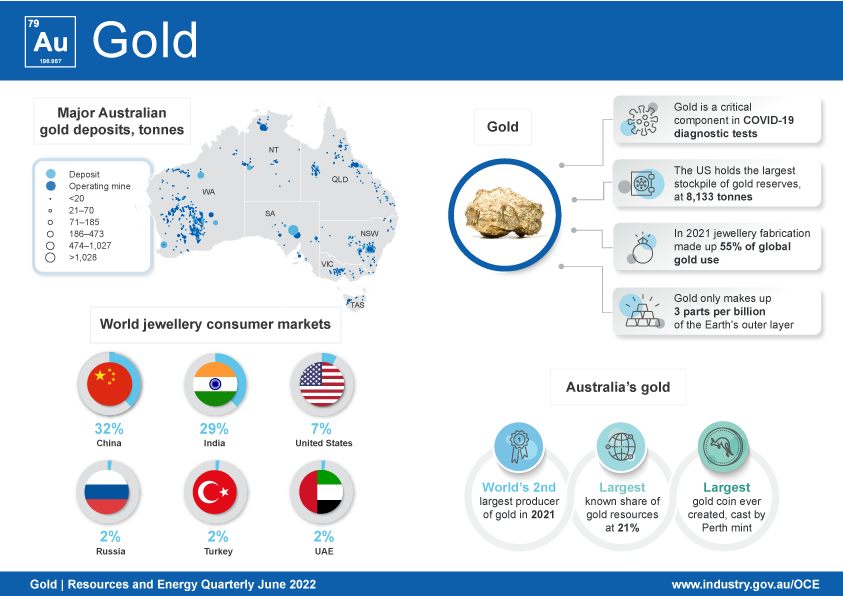

Gold

Australia’s gold export earnings estimated at $23.5 billion in 2021–22.

- Gold prices are expected to average about US$1,850 an ounce in 2022, before falling to an average of US$1,665 in 2024 as loose monetary policy is withdrawn in advanced economies, and safe-haven demand eases.

- Labour and skill shortages affected Australian gold mine production in the March quarter 2022, however production still rose by 3.8% year-on-year. Australian production is forecast to rise from 313 tonnes in 2021–22 to 361 tonnes in 2023–24 as new projects and expansions of existing projects come online.

- Gold earnings are forecast to rise from $23.5 billion in 2021–22 to $25.5 billion in 2023–24, as rising gold export volumes exceed the forecast decline in gold prices.

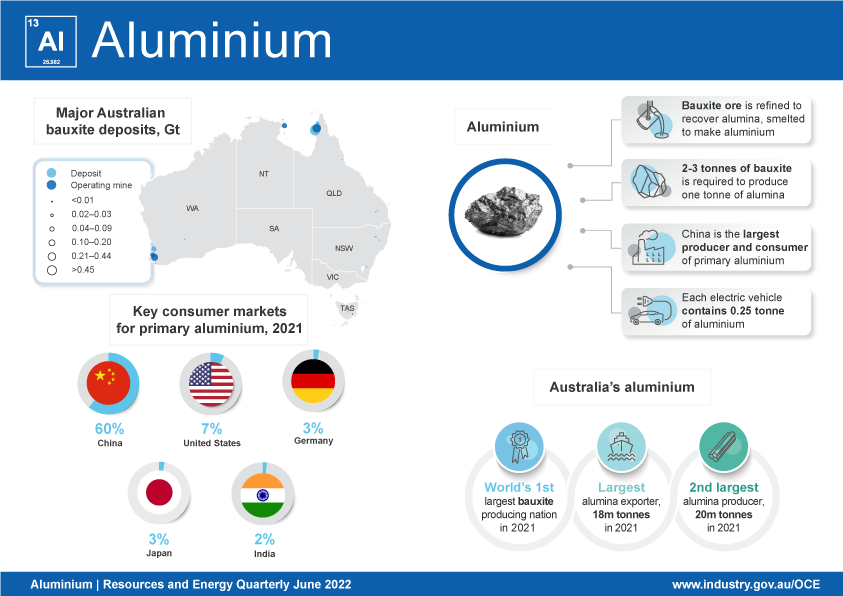

Aluminium, alumina and bauxite

Australia’s aluminium, alumina and bauxite export earnings to rise to $16 billion in 2021–22

- The fallout from the Russian invasion of Ukraine is expected to keep primary aluminium prices at high levels in 2022, averaging US$3,100 a tonne. While prices are forecast to drift down from current highs through the rest of the forecast period, averaging US$2,815 a tonne in 2024, prices will be supported by growing demand for new, energy-efficient cars and technologies.

- Annual Australian output is expected to be broadly steady over the outlook period, remaining at around 1.6 million tonnes of primary aluminium and 21 million tonnes of alumina.

- Australia’s aluminium, alumina and bauxite export earnings are estimated to increase by 31% to $16 billion in 2021–22, and remain at this level by the end of the outlook period.

Copper

Record copper prices support export earnings and Australia’s development potential

- Copper prices increased 51% to US$9,300 in 2021 as global industrial activity recovered from COVID-19. Prices are expected to average US$9,600 in 2022 after a strong start, but will fall back to US$9,000 a tonne in 2024 as surpluses grow.

- Australia’s copper exports are projected to fall to 807,000 tonnes in 2021–22 as scheduled maintenance is completed. Copper exports are expected to grow 977,000 tonnes as production from new mines and mine expansions come online (see Australia section).

- As output and export volumes grow, Australia’s copper export earnings are projected to lift from $11 billion in 2020–21 to $15 billion in 2023–24, up an average 9.3% a year.

Nickel

Strong prices see record export earnings, but will ease over the outlook period

- Nickel prices are expected to average US$25,700 a tonne in 2022, boosted by declining stocks of battery grade material and the fallout from the Russian invasion of Ukraine. Prices are expected to ease over the outlook period, as a result of increased Indonesian production and improving liquidity in the LME market.

- Australia’s export volumes are estimated to have increased to 258,000 tonnes in 2021–22. Over the outlook period, higher nickel prices may incentivise further expansion in nickel production to capitalise on the movement towards low-emission technologies.

- Export earnings have strengthened as a result of high prices following the Russian invasion of Ukraine. Australia’s export earnings are estimated at $6.7 billion in 2021–22, but are expected to ease to $5.7 billion in 2023–24.

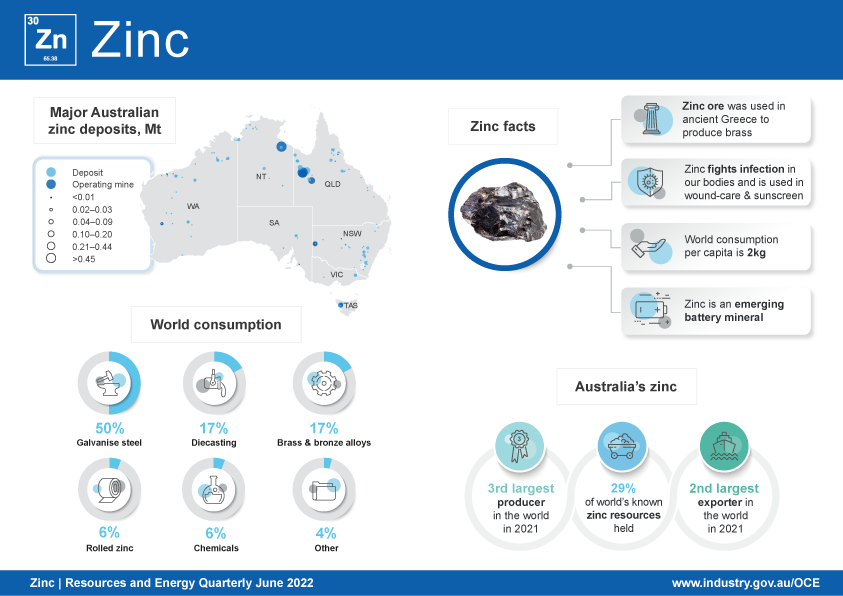

Zinc

Infrastructure spending supports world zinc demand

- The LME zinc spot price is forecast to average around US$3,750 a tonne in 2022, driven by robust global construction activity and continued refined supply shortages in Europe. Prices are forecast to ease over the outlook to around US$2,900 a tonne by 2024, as global supply rises and consumption growth normalises.

- Australia’s zinc production is estimated to be around 1.3 million tonnes in 2021–22, and is forecast to rise by 4.9% per year to around 1.4 million tonnes by 2023–24.

- Australia’s zinc export earnings are estimated to increase to $4.2 billion in 2021–22. Earnings are forecast to peak at $4.6 billion in 2022–23 before easing in 2023–24 to $3.8 billion.

Lithium

Rising prices for lithium are supporting the recovery of Australian producers with lithium hydroxide production underway

- Spodumene prices are forecast to rise from an average US$675 a tonne in 2021 to US$2,235 a tonne in 2022, before easing to about US$1800 a tonne in 2024. Lithium hydroxide prices are forecast to rise from US$17,370 a tonne in 2021 to US$35,570 a tonne in 2022, before easing to about US$28,810 by 2024.

- Australia’s lithium production is forecast to rise by more than half over the outlook period, rising from 278,000 tonnes of lithium carbonate equivalent (LCE) in 2021–22 to 438,000 tonnes of LCE in 2023–24.

- Australia’s lithium export earnings are projected to more than double over the outlook period, from $4.1 billion in 2021–22 to $9.4 billion in 2023-24.