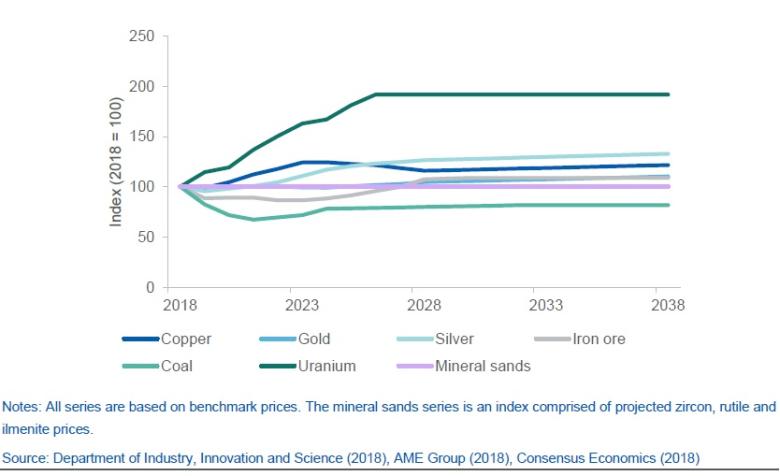

In the short to medium term, price projections are compiled using forecasts from the June 2018 edition of the Resources and Energy Quarterly for the period to 2020, and the March 2018 edition of the Resources and Energy Quarterly for the period from 2021 to 2023. The forecasts in the Resources and Energy Quarterly are based on an assessment of market fundamentals, economic conditions and changes to government policies with the potential to impact on supply or demand. The publication has been produced for 30 years, and contains the Office of the Chief Economist’s forecasts for the value, volume and price of Australia’s major resources and energy commodity exports.

Beyond 2023, price projections are drawn from the AME Group, as published in the June 2018 edition of the Strategic Study reports. AME Group’s long-term price projections are based on the long-term costs of production, the required return on capital to justify new investment, economic development cycles and structural economic changes in the long term. Where AME commodity price projections are unavailable, the average of Consensus Economics’ long-term forecasts are used, as published in the June 2018 edition of the Consensus Economics forecasts. Where production continues beyond the published forecasts of AME and Consensus Economics, a continuation of the price pattern is assumed.

Commodity price assumptions are made in US dollars, and exchange rate assumptions are required to establish the Australian dollar value of production. For the period to 2020, the Australian dollar to United States dollar exchange rate is assumed to follow the assumptions published in the June 2018 edition of the Resources and Energy Quarterly of US$/A$ 0.78. For the period from 2020 onwards, the exchange rate is assumed to average US$/A$ 0.80.

Costs

To determine whether a project is economically viable, the financial (i.e. capital costs and depreciation) and operating costs of the site must be considered. Where available, cost data and other information is used from company reports (including annual reports, scoping studies, feasibility studies, and ASX announcements) or based on data provided by AME Group. Where there are data constraints, costs are approximated based on sites with similar specifications in terms of location, size, depth and/or quality.

Production and resource life

Annual production volumes are based on company reports or data provided by AME Group. In any year, the resource life in terms of years to depletion is equal to the size of the resource (Economic Demonstrated Resources or global resource) at that time divided by the future expected annual production rate. Economic Demonstrated Resources and global resource sizes were provided by Geoscience Australia.

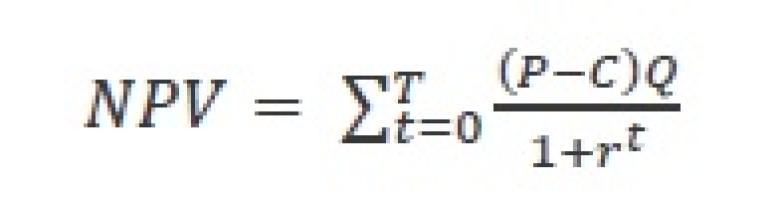

Discount rate

The discount rate is applied to cash flows to determine the present value of future cash flows. This is used to account for the opportunity cost of investment and for the time value of money, that is, the preference for current consumption over consumption in the future. The discount rate used in the analysis to determine the Net Present Value of the mineral resources is 7 per cent. A sensitivity analysis is conducted with 3 and 10 per cent discount rates, consistent with OBPR.

<blue>

Commodity prices can be volatile, and the projections used in this report are subject to a wide range of risks and uncertainties. As such, the impacts of a 10 per cent increase/decrease in commodity prices on the estimated value of mineral resources are considered in a sensitivity analysis in Appendix C.

There is also uncertainty regarding technological developments or further exploration activity which will occur during the life of the mine, which could reduce operation costs or increase the life of the mine. The uncertainty surrounding the estimates of Net Present Values means that the results should be viewed with some caution, and considered alongside the accompanying commentary and geological assessment from Geoscience Australia.

Economic impacts

The economic impact of possible future mine developments are estimated in this report. The analysis does not consider the economic impact of ‘known’ resources, and assumes the discovery and development of mineral deposits of similar size and characteristics to each of the deposits considered in the scenarios. The annual economic impacts associated with the development of each of the deposits are estimated in terms of direct and indirect employment, royalties paid to the South Australian government, and value add to the economy.

Input-Output tables

Mining operations can generate substantial economic activity in both upstream and downstream industries. Input-Output (I-O) analysis is used to estimate the effect of mining developments on indirect employment and value add to the economy, based on tables from the ABS . I-O analysis considers the impact that an initial stimulus can have on an economy through successive spending rounds, by taking into account the relationships between various sectors of the economy in the short-term.

The key advantage of using I-O analysis relates to its simplicity and transparency. However, as the analysis assumes fixed relationships, the results tend to overstate impacts on employment and economic activity. As a result, estimates of economic impacts in this report should be considered an upper-bound estimate. More complex modelling, such Computable General Equilibrium (CGE) models are required to overcome the limitations of I-O analysis, however, these models take far longer to generate, and have their own limitations and challenges.

Results

Assessment of ‘known’ mineral resources

The total Net Present Value of known resources in the WPA is estimated to be around $5.9 billion, based on Economic Demonstrated Resources data provided by Geoscience Australia. Table 7 provides a summary of the estimated Net Present Value by deposit.

Table 7: Value of Economic Demonstrated Resources by deposit in the WPA

| Deposit |

Status |

Commodity |

Economic Demonstrated Resources |

Value

($ million) |

| Challenger |

Operating mine |

Gold |

6.5 t Au |

238 |

| Silver |

0.5 t Ag |

| Prominent Hill |

Operating mine |

Silver |

0.3 kt Ag |

2,110 |

| Copper |

1054 kt Cu |

| Gold |

0.1 kt Au |

| Cairn Hill |

Operating mine (production on hold) |

Iron (magnetite) |

5,982 kt Fe |

181 |

| Copper |

33 kt Cu |

| Gold |

0.001 kt Au |

| Peculiar Knob |

Care and maintenance |

Iron ore (hematite) |

24 Mt |

77 |

| Giffen Well |

Deposit |

Iron (magnetite) |

133 Mt Fe |

1,761 |

| Hawks Nest |

Deposit |

Iron (magnetite) |

54 Mt Fe |

1,188 |

| Commonwealth Hill |

Deposit |

Iron (magnetite) |

5.4 Mt Fe |

19 |

| Lake Phillipson |

Deposit |

Black coal |

320.7 Mt |

98 |

| Penrhyn |

Deposit |

Black coal |

302.3 Mt |

216 |

| Total |

|

|

|

5,889 |

Notes: Values are in real 2018 Australian dollars. Metal symbols in the last column indicate that the resource is measured in metal content terms. Economic Demonstrated Resources current as at 31 December 2016.

Source: Geoscience Australia (2018); Department of Industry, Innovation and Science (2018) |

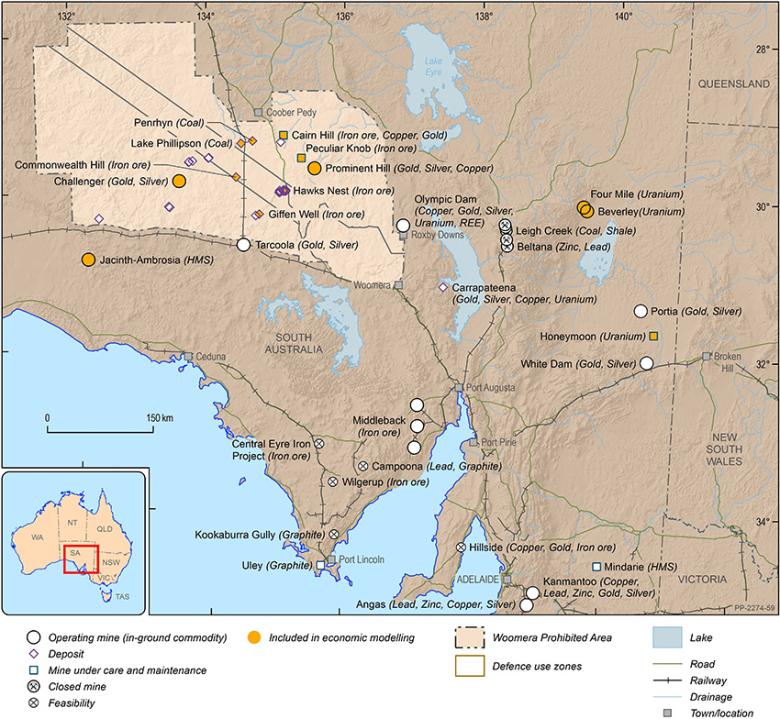

There are currently four deposits (Prominent Hill, Challenger, Cairn Hill and Peculiar Knob) which have been developed in the WPA.

Two of these are currently operating mines. Prominent Hill is a medium-sized copper-gold mine in the eastern region of the WPA, and has an estimated Net Present Value of $2.1 billion. Challenger is a medium-sized gold mine, and has an estimated Net Present Value of $238 million. Reserves (Economic Demonstrated Resources) are expected to maintain production until 2019, with the company seeking to upgrade resources to extend the mine life through further exploration, which could result in a higher Net Present Value in the future.

For simplicity, the analysis assumes that the remaining deposits (which either have been developed but are not currently operating, or have not been developed), are all operating in 2018 and will continue to operate until resource depletion.

Production at Cairn Hill, a magnetite iron ore mine which produces a 55 per cent Fe direct shipping ore production, was suspended in late 2017. Cairn Hill currently has an estimated Net Present Value of $181 million.

The Peculiar Knob mine was placed on care and maintenance in 2015, due to low iron ore prices and high-cost nature of its mining operations. The Net Present Value of the reserves are estimated to be $77 million, but the sensitivity analysis in Appendix C highlights that this operation is marginal — if commodity prices were 10 per cent lower than the base case, the Net Present Value of this operation would become negative.

A further five undeveloped deposits in the WPA contain Economic Demonstrated Resources. These have an estimated total Net Present Value of $3.3 billion. Three of these are magnetite iron ore deposits (Giffen Well, Hawks Nest and Commonwealth Hill), and two of these are black coal deposits (Lake Phillipson and Penrhyn).

Assessment of potential undiscovered mineral resources

The geological potential for additional deposits to be discovered and developed into producing mines within the WPA is estimated by Geoscience Australia. A number of analogue deposits are then used to estimate the value of the mines. Two overarching scenarios have been used to evaluate a conservative and an optimistic outcome (Table 5). Seven analogue deposits are used to represent the discovery and development of possible future mines in the WPA. Assumptions on costs and production are based on existing mines, and updated to reflect current operating conditions and geological information.

Challenger

The Challenger mine began operation within the WPA in 2002, producing gold concentrate on-sold for processing, and with a silver by-product. As a lower bound, Geoscience Australia estimates that there could be one additional Challenger-like deposit discovered and developed within the WPA. As an upper bound it is estimated that there could be three more Challenger-like deposits discovered and developed. Key assumptions for discovering and developing a single Challenger-like deposit are shown in Table 8.

Table 8: Challenger

| Variable |

Assumption a |

| Development time prior to commencing production |

8 years |

| Capital cost |

$50 millionb |

| Average annual operating expenditure per year |

$81 millionb |

| Average production per annum gold |

2.5 t |

| Average production per annum silver |

0.1 t |

| Mine life |

15 years |

|

Notes: a. Assumptions based on AME cost data, company reports and Geoscience Australia’s estimations of potential deposit size in WPA, b. 2018 dollar terms.

|

Prominent Hill

Prominent Hill began production in the WPA in 2009. The mine produces copper, with by-products of gold and silver. As a lower bound, Geoscience Australia estimates that there could be one additional Prominent Hill-like deposit discovered and developed within the WPA. As an upper bound, it is estimated that there could be three more Prominent Hill-like deposits within the WPA. In addition, there is potential for uranium by-product to be included in the future possible mine. A conservative and optimistic grade of uranium is used. Key assumptions for discovering and developing a single Prominent Hill-like deposit, including assumptions for conservative and optimistic uranium by-products are presented in Table 9.

Table 9: Prominent Hill

| Variable |

Assumption a |

| Development time prior to commencing production |

9 years |

| Capital cost |

$1,475 millionb |

| Average annual operating expenditure per year |

$302 millionb |

| Additional annual operating expenditure per year with uranium |

$45 millionb |

| Average production per annum copper |

101 kt |

| Average production per annum gold |

31 t |

| Average production per annum silver |

18 t |

| Average production per annum uranium - conservative |

1.5 kt |

| Average production per annum uranium – optimistic |

2.0 kt |

| Mine life |

22 years |

|

Notes: a. Assumptions based on AME cost data, company reports and Geoscience Australia’s estimations of potential deposit size in WPA, b. 2018 dollar terms.

|

Peculiar Knob

The Peculiar Knob mine began mining in 2012, but was placed under care and maintenance in 2015, due to low iron ore prices at the time. As a lower bound, Geoscience Australia estimates that one Peculiar Knob-like deposit could be discovered and developed in the WPA. As an upper bound, potentially two Peculiar Knob-like deposits could be discovered and developed. Table 10 presents the key assumptions for a single Peculiar Knob mine.

Table 10: Peculiar Knob

| Variable |

Assumption a |

| Development time prior to commencing production |

7 years |

| Capital cost |

$200 millionb |

| Average annual operating expenditure per year |

$254 millionb |

| Average production per annum iron |

2.9 Mt |

| Mine life |

15 years |

|

Notes: a. Assumptions based on AME cost data, company reports and Geoscience Australia’s estimations of potential deposit size in WPA, b 2018 dollar terms.

|

Giffen Well

Feasibility studies were completed for Giffen Well in 2013, and production was targeted for 2017. However, the project was not completed due to perceived risks of falling iron ore magnetite prices at the time. Assumptions used for discovering and developing a single Giffen Well-like deposit under current operating conditions are in Table 11. As a lower bound, Geoscience Australia estimates that one more Giffen Well-like deposit could be mined in the WPA. As an upper bound, it is estimated that three Giffen Well-like deposits mined in the WPA.

Table 11: Giffen Well

| Variable |

Assumption a |

| Development time prior to commencing production |

9 years |

| Capital cost |

$1,020 millionb |

| Average annual operating expenditure per year |

$347 millionb |

| Average production per annum iron |

4.7 Mt |

| Mine life |

35 years |

|

Notes: a. Assumptions based on company reports and Geoscience Australia’s estimations of potential deposit size in WPA, b 2018 dollar terms.

|

Honeymoon

The existing Honeymoon mine is located approximately 80 km north-west of the town of Broken Hill near the South Australia and New South Wales border. After beginning production in 2011, the Honeymoon mine went into care and maintenance in 2013, primarily due to a decline in uranium prices. Feasibility studies have been conducted and plans are underway to restart the mine and expand capacity to improve the mine’s viability. Assumptions for discovering and developing a Honeymoon-like deposit in the WPA are presented in Table 12. As part of a lower bound scenario, Geoscience Australia estimates that one Honeymoon-like deposit could be discovered and developed in the WPA.

Table 12: Honeymoon

| Variable |

Assumption a |

| Development time prior to commencing production |

9 years |

| Capital cost |

$250 millionb |

| Average annual operating expenditure per year |

$81 millionb |

| Average production per annum uranium |

1,120 t |

| Mine life |

9 years |

|

Notes: a. Assumptions based on Company reports, World Nuclear Association data and Geoscience Australia’s estimations of potential deposit size in WPA, b. 2018 dollar terms.

|

Jacinth-Ambrosia

Jacinth-Ambrosia is a mining and concentrating operation in the Eucla Basin, 800 kilometres from Adelaide. The operation primarily produces zircon with by-products of rutile and ilmenite. As part of an upper bound scenario, Geoscience Australia estimates that a single Jacinth-Ambrosia deposit could be discovered and developed in the WPA. Assumptions for discovering and developing a single Jacinth-Ambrosia-like deposit in the WPA are presented in Table 13.

Table 13: Jacinth-Ambrosia

| Variable |

Assumption a |

| Development time prior to commencing production |

6 years |

| Capital cost |

$400 millionb |

| Average annual operating expenditure per year |

$209 millionb |

| Average production per annum Zircon |

231 kt |

| Average production per annum Rutile |

24 kt |

| Average production per annum Ilmenite |

102 kt |

| Mine life |

22 years |

|

Notes: a. Assumptions based on Company reports and Geoscience Australia’s estimations of potential deposit size in WPA, b. 2018 dollar terms.

|

Four Mile and Beverley

Four Mile and Beverley are two uranium mines, located in close proximity to each other and approximately 550 kilometres north of Adelaide. The Beverley mine ceased production in 2014, while Four Mile is currently still in operation. As part of an upper bound scenario, Geoscience Australia estimates that a combined Four Mile and Beverley-like deposit could be discovered and developed in the WPA. Key assumptions for discovering and developing a single Four Mile and Beverley-like deposit are presented in Table 14.

Table 14: Four Mile and Beverley

| Variable |

Assumption a |

| Development time prior to commencing production |

9 years |

| Capital cost |

$250 millionb |

| Average annual operating expenditure per year |

$97 millionb |

| Average production per annum Uranium |

1,367 t |

| Mine life |

22 years |

|

Notes: a. Assumptions based on Company reports, World Nuclear Association data and Geoscience Australia’s estimations of potential deposit size in WPA, b 2018 dollar terms.

|

Net Present Values of future potential mines

The Net Present Value of each future potential mine is shown in Table 15. Using the upper and lower bound scenarios provided by Geoscience Australia and the individual mine Net Present Values presented in Table 15, the possible future mines in the WPA are estimated to have a Net Present Value between $6.4 billion and $19 billion.

Table 15: Quantities and Net Present value of future possible mines

| Future possible mines |

Commodity |

Assumed total production over mine life a |

Net Present Value b$m 2018, discount rate 7 per cent |

| Challenger |

Gold |

37.1 t Au |

354 |

| Silver |

1.5 t Ag |

| Prominent Hill |

Copper |

2,222 kt |

4,347 c |

| Gold |

0.1 kt Au |

| Silver |

0.4 kt Ag |

5,235 d |

| Uranium Conserative |

33.3 kt U |

5,628 e |

| Uranium Optimistic |

44.4 kt U |

| Peculiar Knob |

Iron Ore |

44 Mt |

119 |

| Giffen |

Iron Ore |

166 Mt Fe |

626 |

| Honeymoon |

Uranium |

10 kt U |

64 |

| Jacinth-Ambrosia |

Zircon |

5,075 kt |

1,362 |

| Rutile |

541 kt |

| Ilemnite |

2,233 kt |

| Four Mile and Beverley |

Uranium |

30 kt U |

290 |

|

Notes: Metal symbols in the last column indicate that the resource is measured in metal content terms a Assumed total production over mine life is based on Global Resource estimates from Geoscience Australia (see Appendix B) and per annum capacity of individual mining operations, b Net Present Value for the total future possible mine; c Prominent Hill Net Present Value without added Uranium; d Prominent Hill Net Present Value with Conservative grades of Uranium; e Prominent Hill Net Present Value with Optimistic grades of Uranium.

|

Economic impacts

The economic impact of the hypothetical development of each mine project outlined in the above scenarios are explored. The analysis is based on the assumption that mineral deposits of similar size and characteristics to each project will be discovered and developed. Table 16 presents the results of the estimated economic effects of each mine project.

The projects have not been aggregated when measuring wider economic impacts. Aggregation of the projects into the lower and upper bound scenarios would require consideration of economy-wide effects of the projects occurring simultaneously.

Table 16: Annual average economic impact of future possible mine developments

| Future possible mine |

Value of output

($ million) |

Cost of output

($ million) |

Direct employment (no.) |

Secondary employment

(no.) |

Value add ($ million) |

Royalties ($ million) |

| Challenger |

153 |

84 |

250 |

150 |

110 |

3 |

| Prominent Hill |

| — No Uranium |

1,151 |

302 |

1,350 |

840 |

620 |

42 |

| — Conservative Uranium |

1,337 |

347 |

1,370 |

1,150 |

840 |

50 |

| — Optimistic Uranium |

1,399 |

347 |

1,380 |

1,250 |

920 |

53 |

| Peculiar Knob |

254 |

209 |

150 |

70 |

8 |

3 |

| Giffen |

529 |

347 |

550 |

120 |

14 |

13 |

| Honeymoon |

137 |

81 |

150 |

230 |

170 |

3.5 |

| Jacinth-Ambrosia a |

428 |

206 |

na |

na |

na |

15 |

| Four Mile and Beverley |

167 |

97 |

150 |

280 |

200 |

3.5 |

|

Notes: a Secondary employment and value add cannot be estimated for Jacinth-Ambrosia due to data limitations. Source: Department of Industry, Innovation and Science – Resources and Energy Quarterly (June 2018), Company reports.

|

Other considerations

Sensitivity analysis

Given that the assumed benefits of known resources and possible future mine scenarios occurs into the future, uncertainties are tested using sensitivity analysis. Two key variables are tested in the sensitivity analysis: the discount rate and commodity prices, with the results presented in Appendix C.

If commodity prices are 10 per cent lower than what has been used in the base case, the value of known mineral resources declines substantially, from $5.9 billion to $2.1 billion. In addition, the lower prices make iron ore projects Peculiar Knob and Commonwealth Hill, and coal projects Lake Phillipson and Penrhyn return negative Net Present Values. Similarly for possible future mines, Peculiar Knob gives negative returns under the lower price sensitivity analysis.

A higher discount rate for possible future mine scenarios delivers a material effect to the Net Present Value of the upper and lower bound scenarios. The range of values under the base case of a 7 per cent discount rate is between $6.4 billion and $19 billion. Under the higher discount of 10 per cent, the range of value is between $3.7 billion and $11 billion. Under the 3 per cent discount rate, the range of value is between $14 billion and $40 billion. Sensitivity to the discount rate can be expected, due to the high upfront capital outlays and long lead-in time before revenues are generated, a characteristic of many mining projects.

Developing mineral resources

The analysis in this report assumes the discovery and development of mineral Economic Demonstrated Resources and future potential mines in the WPA. However, in reality, exploration and mining investment only occurs under appropriate conditions, with many factors affecting the decision to undertake exploration activities and commit funding to projects, including the regulatory environment, tax and royalty arrangements, community acceptance, technical risks and access to infrastructure.

Commodity prices and exchange rates can be subject to volatility, which increases the financial risks and affects the commercial viability of a project. For example iron ore projects Peculiar Knob and Giffen Well were halted after prices declined in 2013. While mining deposits of similar size and characteristics could be viable in the future, investment in such projects would depend on the perceived risks of the operating environment.

Another important consideration is the availability of capital and labour when viewing the aggregated future possible mine scenarios and Economic Demonstrated Resources. The Net Present Value calculation and aggregations assume that there are enough resources for multiple additional projects to be realised in the WPA. This should be considered when interpreting the potential values.

Economic impacts

The assessment of economic impacts in this report uses I-O analysis to derive estimates of the economic activity that would be generated as a result of the development of mining projects. There are a number of limitations associated with this method, described in the methodology. In particular, this method often results in the overstatement of the impacts on employment and economic activity, and as a result, estimates of economic impacts in this report should be considered an upper-bound estimate. More complex modelling, such Computable General Equilibrium models would be required to overcome the limitations of I-O analysis.

There are also other economic impacts associated with the development of mining projects that have not been quantified in this report. For example, mining project developments affect both the current and capital accounts of the balance of trade. In addition to increasing Australian exports, growth in the sector also increases imports, particularly during the construction. The involvement of foreign entities through direct and portfolio investments also affects the capital account, with investments recorded as an inflow and repatriation of profits and dividends recorded as an outflow. Mining companies can also provide broader benefits to the wider community, which have not been considered in this report, such as introducing new technologies and expertise, and the provision of infrastructure, particularly in remote areas.

Conclusion

The Net Present Value of Economic Demonstrated Resources in the WPA is estimated to be $5.9 billion. Possible future mines in the WPA are estimated to have a Net Present Value between $6.4 billion and $19 billion. From the Economic Demonstrated Resources calculations, the Iron deposits contribute the most value with an estimated Net Present Value of $3.2 billion. For future possible mines, the Net Present Value of copper, as part of a Prominent Hill-like deposit, is the highest value commodity with an estimated value between $3.5 billion and $11 billion.

In terms of economic impacts, large mineral developments, such as that modelled in the Prominent Hill-like future potential mine, have the potential to have large employment and value add effects. The economic impacts of the other future potential mines have relatively smaller effects, but would still have the potential to materially increase employment and economic activity. Annual direct employment across the future possible mines ranges from 150 to 1,350 people, with secondary employment between 70 and 1,250 people. Annual value add across the future possible mines ranges between $8 million to $920 million.

The analysis in this report assumes the discovery and development of mineral Economic Demonstrated Resources and future potential mines in the WPA. However, in reality, exploration and mining investment only occurs under appropriate conditions, with many factors affecting the decision to undertake exploration activities and commit funding to projects. These factors should be considered when interpreting the values.

Appendix A: Acronyms and units

Table A1: Acronyms

| Acronym |

Definition |

| ABS |

Australian Bureau of Statistics |

| ASX |

Australian Securities Exchange |

| CFR |

Cost and Freight |

| CGE |

Computable General Equilibrium |

| EDR |

Economic Demonstrated Resource |

| FOB |

Free on Board |

| GA |

Geoscience Australia |

| GDP |

Gross Domestic Product |

| GSP |

Gross State Product |

| I-O |

Input-Output |

| LBMA |

London Bullion Market Association |

| LME |

London Metals Exchange |

| NPV |

Net Present Value |

| OBPR |

Office of Best Practise Regulation |

| OCE |

Office of the Chief Economist |

| PEPR |

Program for Environment Protection and Rehabilitation |

| SEEA |

System of Environmental-Economic Accounting |

| SNA |

System of National Accounts |

| WPA |

Woomera Prohibited Area |

Table A2: Units and minerals

| Units |

Units |

Minerals |

Minerals |

| kcal |

Kilocalories |

Ag |

Silver |

| Kg |

Kilograms |

Au |

Gold |

| t |

Tonnes |

Cu |

Copper |

| kt |

Thousand tonnes |

Fe |

Iron |

| Mt |

Million tonnes |

U3O8 |

Uranium oxide |

Appendix B: Geological terminology and data

Geological terminology

Table B3: Glossary of geological terminology

| Term |

Definition |

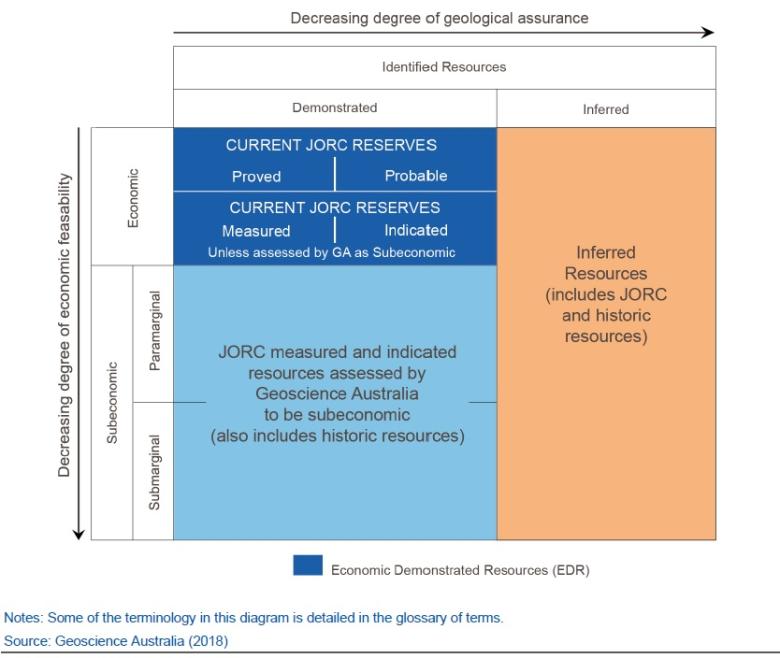

| Economic Demonstrated Resources |

A collective term which includes the Joint Ore Reserve Committee (JORC) Code categories of: ‘Measured Mineral Resources’, ‘Indicated Mineral Resources’, ‘Proved Ore Reserves’ and ‘Probable Ore Reserves’. These are resources that are well understood geologically, and have been regarded as economically feasible to extract or produce with reasonable certainty. |

| Inferred Resources |

Resources for which quantitative estimates are based largely on broad knowledge of the geological character of the deposits and for which where are few, if any sample or measurements. |

| Total Resource |

Total Resource = Economic Demonstrated Resource + Inferred Resource |

| Global Resource |

Global Resource = Total Resource + Past Production |

Geological data

Table B2: Deposits within the WPA for Economic Demonstrated Resources valuation

| Deposit |

Status |

Commodity |

Economic Demonstrated Resources |

| Challenger |

Operating mine |

Gold |

6.5 t Au |

| Silver |

0.5 t Ag |

| Prominent Hill |

Operating mine |

Silver |

0.3 kt Ag |

| Copper |

1054 kt Cu |

| Gold |

0.1 kt Au |

| Cairn Hill |

Operating mine (production on hold) |

Iron (magnetite) |

5,982 kt Fe |

| Copper |

33 kt Cu |

| Gold |

0.001 kt Au |

| Peculiar Knob |

Care and maintenance |

Iron ore (hematite) |

24 Mt |

| Giffen Well |

Deposit |

Iron (magnetite) |

133 Mt Fe |

| Hawks Nest |

Deposit |

Iron (magnetite) |

54 Mt Fe |

| Commonwealth Hill |

Deposit |

Iron (magnetite) |

5.4 Mt Fe |

| Lake Phillipson |

Deposit |

Black coal |

320.7 Mt |

| Penrhyn |

Deposit |

Black coal |

302.3 Mt |

Notes: Metal symbols in the last column indicate that the resource is measured in metal content terms. Economic Demonstrated Resources current as at 31 December 2016.

Source: Geoscience Australia (2018) |

Table B3: Analogue deposits to be included in possible future mine developments scenarios

| Future possible mines |

Commodity |

Total resource |

Past production |

Global resource |

| Challenger |

GoldSilver |

8.2 t Au0.57 Ag |

32.8 t Au1.31 Ag |

41 t Au1.88 Ag |

| Prominent Hill |

Copper |

1,740 kt Cu |

830 kt Cu |

2,570 kt Cu |

| Gold |

0.11 kt Au |

0.04 kt Au |

0.15 kt Au |

| Silver |

0.46 kt Ag |

0.21 kt Ag |

0.67 kt Ag |

| Uranium Conserative |

27 kt U |

12 kt U |

40 kt U |

| Uranium Optimistic |

36 kt U |

16.6 kt U |

53 kt U |

| Peculiar Knob |

Iron Ore (hematite) |

34.3 Mt |

10 Mt |

45 Mt |

| Giffen |

Iron Ore (magnetite) |

213 Mt Fe |

0 |

213 Mt Fe |

| Honeymoon |

Uranium |

9.8 kt U |

0.31 kt U |

10 kt U |

| Jacinth-Ambrosia |

Rutile |

0.53 Mt |

0.015 Mt |

0.5 Mt |

| Zircon |

5.5 Mt |

0.152 Mt |

5.6 Mt |

| Ilemnite |

9.8 Mt |

0.274 Mt |

10 Mt |

| Four Mile and Beverley |

Uranium |

31 kt U |

3.1 kt U |

34 kt U |

Notes: Metal symbols in the last column indicate that the resource is measured in metal content terms. In almost all cases, the global resource for each analogue deposit (Economic Demonstrated Resources + Inferred Resource + cumulative production) has been used to model the total size of the future hypothetical resource. For Giffen Well, where no production has occurred, the sum of the Economic Demonstrated Resources and Inferred Resource has been used to model the total size of the future iron ore resource.

Source: Geoscience Australia (2018); Department of Industry, Innovation and Science (2018) |