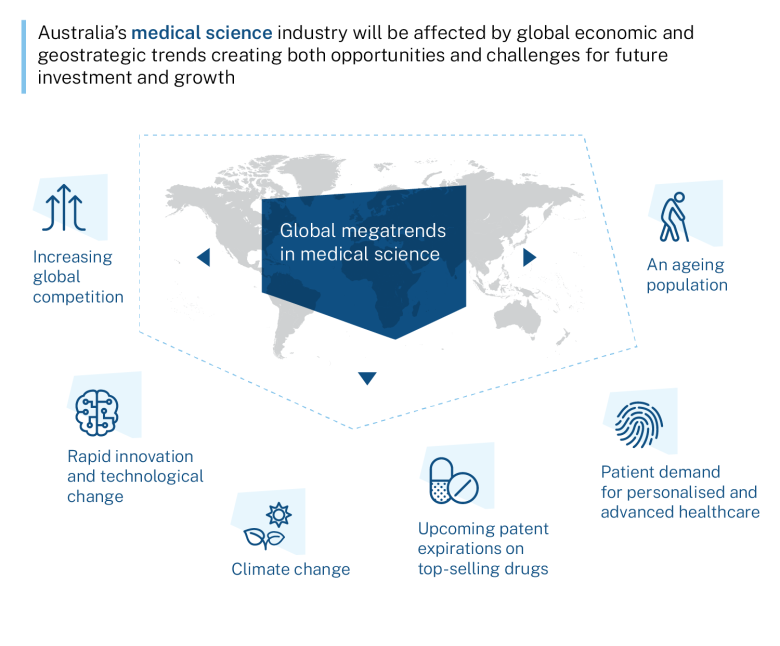

Co-investment plans are a part of the Australian Government’s commitment to secure a stronger future for Australian manufacturing. They bolster the government’s plan to rebuild, modernise and diversify Australian manufacturing so that we continue to be a country that makes things to the benefit of the economy and local communities. Australia needs a vibrant manufacturing industry to improve economic resilience and build a smart and diverse economy.

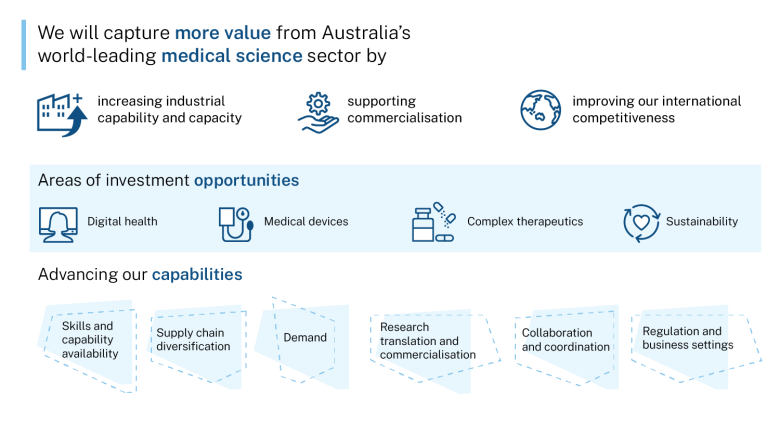

The co-investment plans target the 7 priority areas of the economy identified by the government. They outline:

- promising areas for investment in the priority areas to support the development of high-value, sustainable manufacturing capabilities

- potential further actions to help build ecosystems that support manufacturing growth and competitiveness in the priority areas.

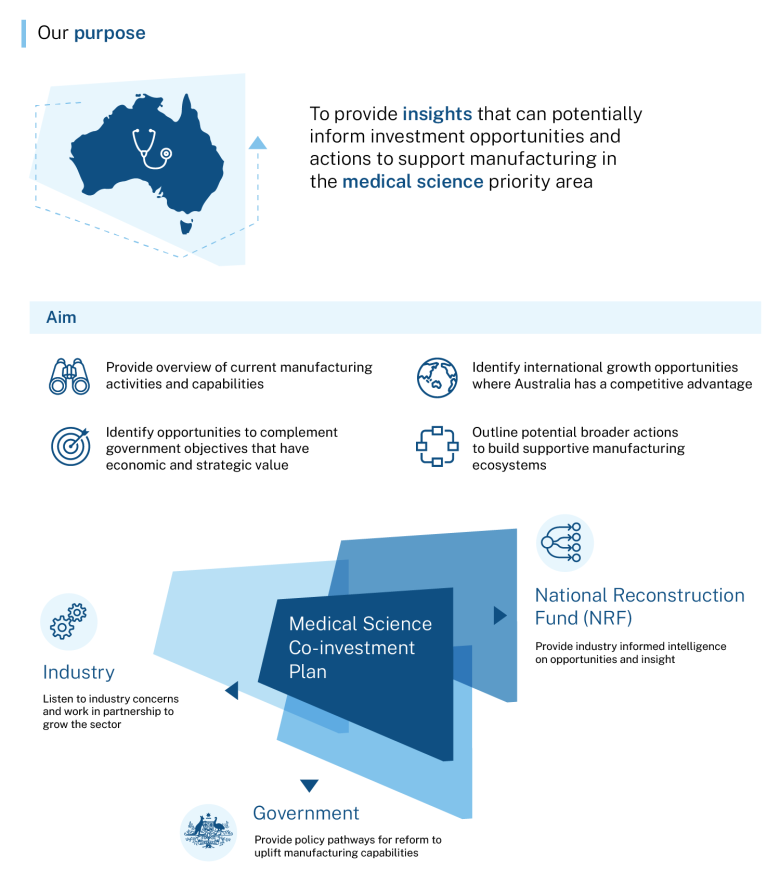

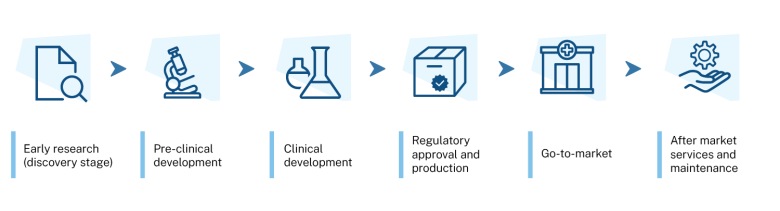

This co-investment plan for the medical science priority area sets out the government’s commitment to back Australia’s medical know-how to make more medical products here in Australia. We have world-class medical research capabilities and workforce. By building on our strengths and existing productive capacity, we can meet current and future needs and keep Australians safe and well.

The co-investment plans are developed with industry and are a coordinated effort to ensure we seize future opportunities and create well-paid, secure jobs in suburban and regional Australia. The plans complement government initiatives to enhance innovation and expand domestic manufacturing. This includes the National Reconstruction Fund Corporation, which is one of the largest investments in manufacturing in our history. It also includes the Industry Growth Program, which delivers advice and grants to help start-ups and small businesses commercialise ideas and grow.

This plan was developed in consultation across government, industry, peak bodies, academia and unions. I thank the many people and organisations who provided expert advice to support this plan’s development. The government is committed to continuing to work collaboratively with industry to transform and diversify Australian manufacturing.