The AIS provides a concise and accessible way to see how the Australian innovation environment is supporting productivity growth.

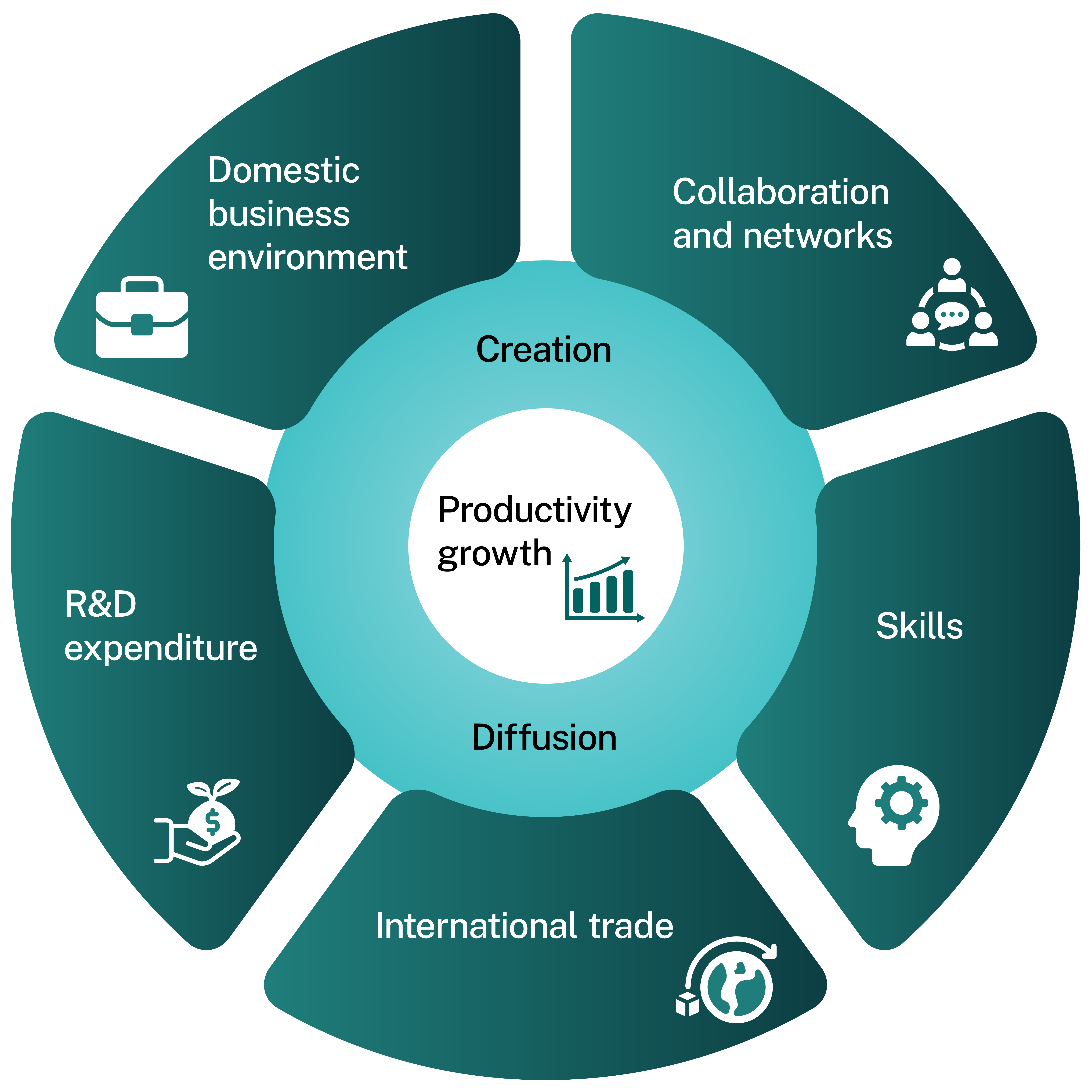

The AIS metrics track key enabling factors of innovation relating to the domestic business environment, collaboration, skills, international trade and research and development expenditure. These factors combine to deliver innovation outcomes, including the creation and diffusion of knowledge and technology, and subsequent impacts on the economy.

We developed the AIS with reference to current best practice on innovation measurement. Read more about how we developed the AIS.