Innovation is the process of creating new knowledge and technology and adopting it across the economy. It is a key driver of productivity, economic growth and a higher standard of living.

The newly published Australian Innovation Statistics (AIS) contains 6 data dashboards on aspects of the Australian innovation system. The metrics in the AIS highlight the resilience of Australian innovators. Despite challenging business conditions in recent years, Australian innovation has continued to grow.

We drew out some key messages from these data.

Australian innovation is growing

Australia’s innovation continue to grow relative to pre-pandemic levels and there has been an increase in the number of businesses engaged in innovation. Australia performs well compared to our Organisation for Economic Co-operation and Development (OECD) peers. This is despite ongoing challenges around access to finance and skills.

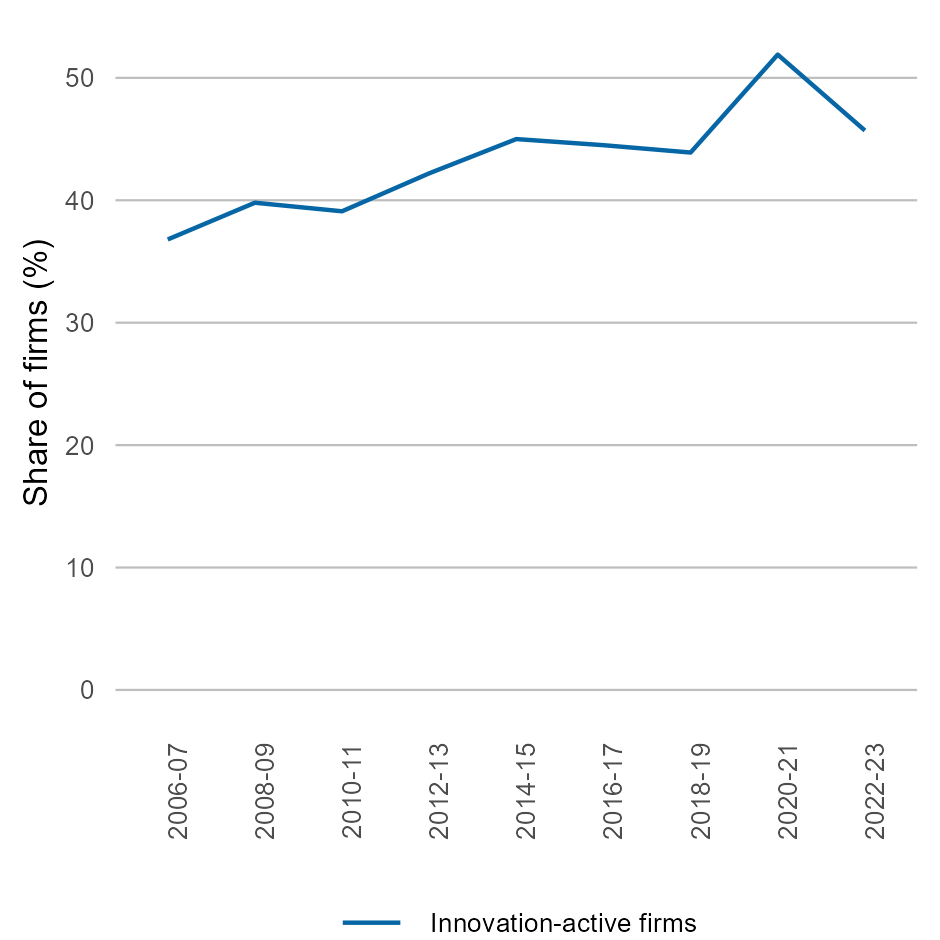

Chart one shows almost half (45.7%) of Australian businesses took part in innovative activities in 2022–23. These figures are the highest recorded over the last decade, excluding a surge during the pandemic, which drove an intense period of innovation. Australia performs well to its peers on this metric, ranking 7 out of 39 countries in the latest OECD innovation survey, held in 2023.

The Innovation Outcomes dashboard shows that the highest levels of activity were in the ICT, manufacturing and wholesale trade industries. For example, in 2022–23, the share of firms that were innovation-active in each of these industries was more than 50 per cent (ABS 2024a). Australian innovation-active businesses continue to self-report more productivity gains and better performance on other criteria like taking part in social causes, compared with non-innovation peers (ABS 2024a).

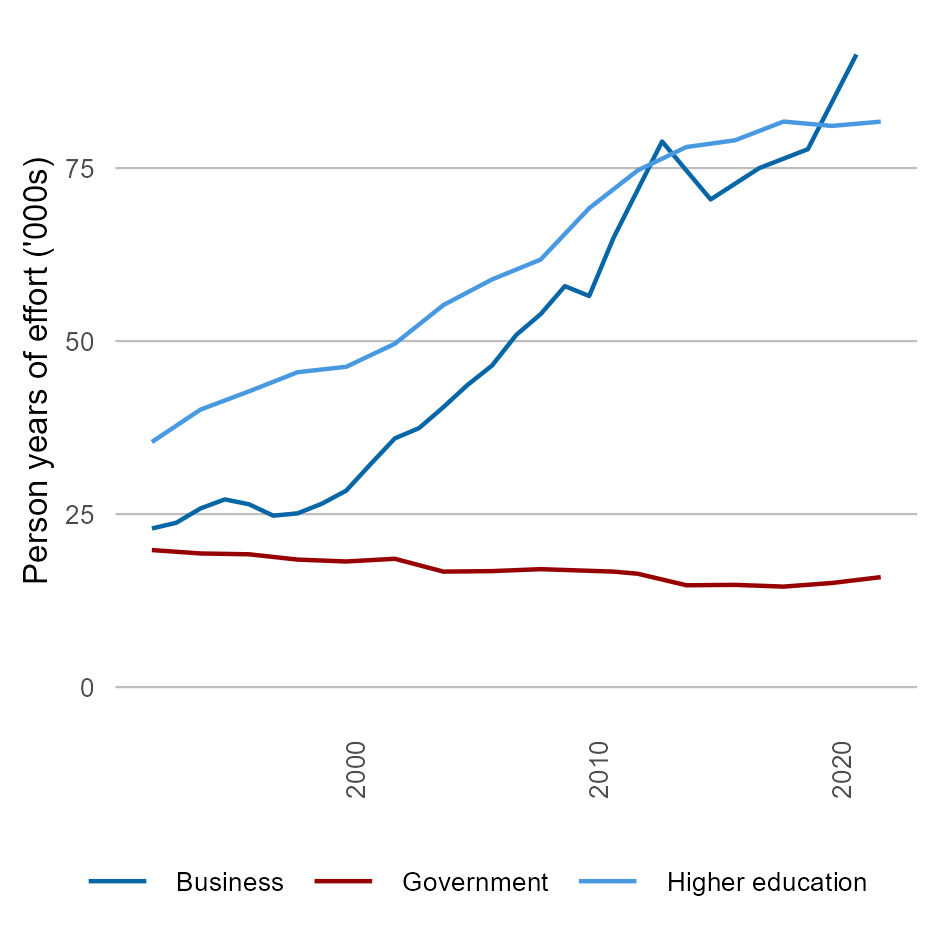

These trends coincide with changes in a range of factors that help business innovate. For example, data on human capital and skills in chart 2 shows that up to 2022 (the most recent data) business and higher education sectors had record high employment rates for research and development (R&D) specialists.

The collaboration dashboard shows increased interaction on innovation between customers, suppliers and consultants, and increasing rates of international co-authorship on scientific publications across all fields (ABS 2024a). For example, the proportion of Australian publications in Engineering and Technology with international co-authorship has surged from 23% to 74% of publications between 2000 and 2023 (Clarivate 2024).