The December 2023 edition of the Resources and energy quarterly (REQ) and the 2023 Resources and energy major projects (REMP) were released today by the Department of Industry, Science and Resources.

The outlook for Australian resource and energy commodity exports has improved slightly since the September edition of the REQ. The world economy has not slowed as sharply as feared a few months ago and the Chinese Government has taken further measures to stabilise the nation’s residential property sector, maintaining demand for a range of commodities.

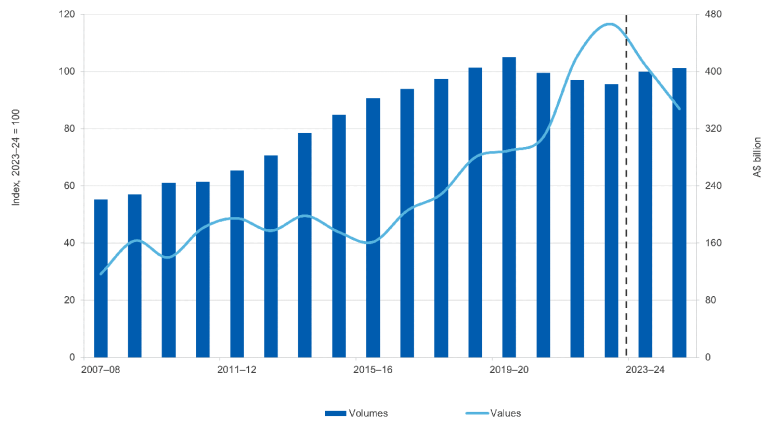

The latest forecast is for weaker growth in world demand and improving world commodity supply to cut Australia’s resource and energy export earnings from a record $466 billion in 2022–23 to $408 billion in 2023–24. A further fall seems likely in 2024–25, as commodity prices soften further and more favourable interest rate differentials drive a strengthening in the Australian dollar. The latest forecast is broadly consistent with previous REQ forecasts.

Highlights from the December REQ are:

- Improved market sentiment following Chinese Government measures to stabilise its property market, and low Chinese iron ore inventories have pushed iron ore prices above US$120 a tonne, but some retreat from this is expected over the next 2 years.

- High inventories in China have seen thermal coal prices fall in recent months. The metallurgical coal market remains tight due to supply problems. Prices for both coal types are expected to decline over time.

- Oil prices are drifting down as weak world demand is being partly offset by OPEC+ supply cuts. The recent conflict in the Middle East has not yet had a significant or lasting impact on oil prices.

- Lithium prices have fallen further from the peaks of late 2022, due to increased supply and concerns about the near-term demand for electric vehicle production.

- Uranium prices have surged in recent months, driven by supply issues and a more rapid expansion of nuclear power as nations seek to improve energy security and meet net zero commitments.