The Office of the Chief Economist has just released the Coal in India 2019 report.

The report examines the future of thermal coal in India, India’s future import requirements and the implications for Australian exporters. Coal in India 2019 provides an update to the 2015 report; since then, India has become the world’s second largest coal producer and consumer.

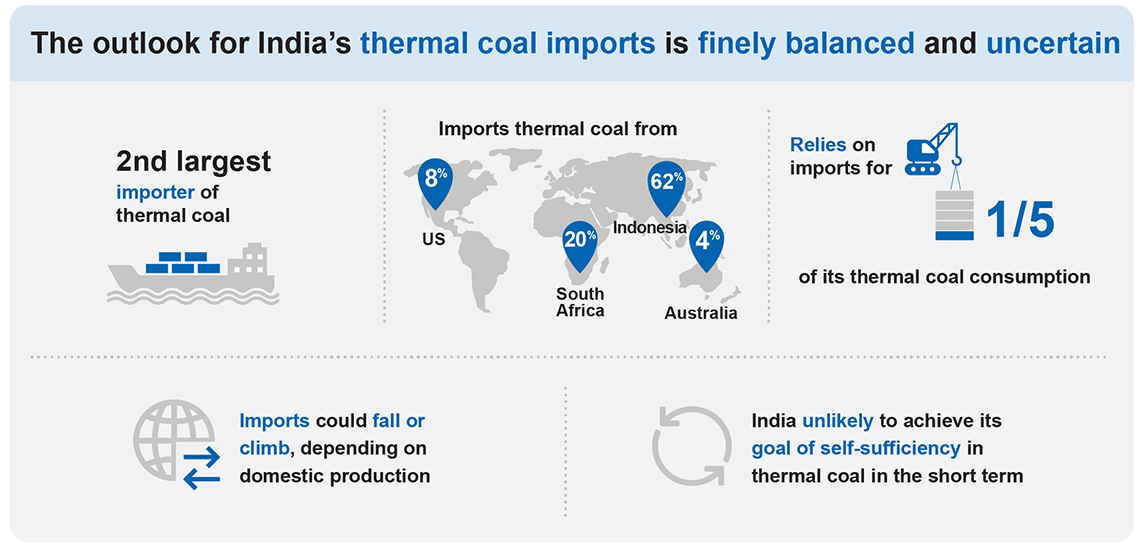

As the world’s third largest energy consumer and second largest thermal coal importer, India’s energy future will help shape seaborne thermal coal markets for decades to come.

The report finds that thermal coal consumption is likely to continue to increase next decade, and possibly beyond, in order to meet India’s increasing energy requirements. However, in the longer term, coal demand will depend heavily on the pace of expansion in renewable generation in India.

Another key factor will be the pace of growth in Indian coal production. India has ambitious targets, but faces challenges in its coal sector around approvals, land acquisition, productivity, transport and pricing.

Overall, the outlook for India’s thermal coal imports is finely balanced. A number of scenarios are possible, and the future for India’s thermal coal imports depends on movements in the balance of India’s future coal production and consumption.

Australia is currently not a significant supplier of thermal coal to India, but there are opportunities. The report discusses the opportunities, but also the barriers, for Australian thermal coal exporters and the Australian mining equipment, technology and services (METS) sector.

‘This report contributes to the debate by examining the key drivers, current trajectory and main uncertainties that could impact on future developments,’ the department’s Chief Economist David Turvey said.

Read more

- Read the Coal in India 2019 report.

- Learn more about the Office of the Chief Economist.

Media contact

- Phone 02 6213 6308

- Email media@industry.gov.au

Key data