Addressing climate change is the defining challenge of our time. The government is transitioning Australia’s electricity grid to 82% renewable energy by 2030. This will support Australia’s commitment to reduce emissions by 43% by 2030 and realise the economic opportunities that the net zero transformation presents for Australia.

Strong and secure battery supply chains will be essential to achieving this transformation. The Australian Energy Market Operator (AEMO) has forecast that Australia will need 19 GW of energy storage capacity in the grid by 2030. This will more than double to 43 GW by 2040, with over a half of it in home and community batteries (including EV to grid) (AEMO 2023).

Battery industries have a long history in Australia. Australian businesses like Century Batteries have been manufacturing lead acid batteries continuously since 1928. Demand for batteries is expected to grow sharply in the near future. Cumulative energy storage capacity is forecast to grow to 1,877 gigawatt hours (GWh) by 2030 (Kou 2023), up from 34GWh in 2020. This is expected to attract USD$262 billion in investment between 2021 and 2030 (Bloomberg 2021). The growth in domestic and global demand for a diverse range of batteries creates a significant opportunity for Australian battery manufacturers. This strategy will support Australian manufacturers to make the most of these opportunities.

Major economies around the world are acting quickly to secure the global capital investment, skills and mineral resources they need to build clean energy industries. However, more than 75% of batteries are currently produced in one country. As this market evolves, it’s important to ensure Australia builds sovereign capabilities where it is a necessary and efficient way to strengthen Australian economic resilience or security.

Australia has a role to play in diversifying global supply chains. Australian battery innovation and manufacturing can meaningfully reduce economic vulnerabilities and make an important contribution to Australia’s trade partnerships. Building this industry now will ensure Australia can develop and access the newest battery technologies, securing the economy and helping protect against potential market shocks.

Demand for battery recycling is also growing. Effective development of battery recycling practices and markets will be critical to ensuring that batteries continue to have a positive environmental impact and promote the growth of circular economy.

A strong battery industry will help improve the lives of Australians and support economic resilience and security into the future. For this industry to thrive, we need Australian battery manufacturers and researchers to create new projects and technologies. We need batteries built to power our net zero transition, and ready to export across the globe to power the world’s shift to green energy. We need to create a competitive and diverse domestic battery sector.

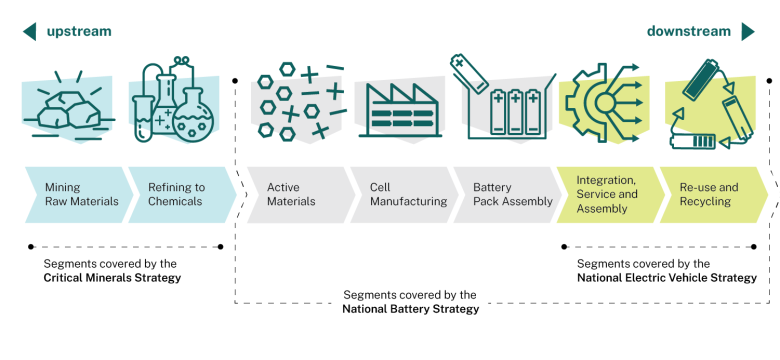

To achieve this, we must move the industry further downstream from minerals extraction and refining to higher value products. By doing this, we’ll build a stationary storage battery manufacturing industry that uses our rich mineral wealth and high penetration of solar and wind. Australia has potential to contribute value-added products like battery active materials to the global EV industry, and support the electrification of our mining, defence and heavy transport sectors by producing batteries for the vehicles we manufacture here.

There are clear opportunities for a battery industry in Australia. We can:

- build stationary energy storage to transition our grid and our region to renewable energy

- upgrade Australia’s battery minerals into active materials for the global EV industry

- produce batteries for heavy vehicles and equipment Australia excels in manufacturing

- ensure safe and secure operations for batteries with enabling technology.

The National Battery Strategy sets out the pathway for governments, industry and researchers to realise these opportunities. These actions will strengthen Australia’s position in global battery supply chains and expand Australia’s battery manufacturing capabilities in ways that improve Australia’s economic resilience and security. This means we’ll be able to secure our part of the global renewable energy transition opportunity and build Australia’s ongoing energy security.

The strategy has been developed in consultation with industry, researchers, unions, state and territory governments, and the community.

This strategy is also underpinned by significant consultation and analysis and backed by government action. The centrepiece is the $523.2 million Battery Breakthrough that will provide production-linked incentives to Australian battery manufacturers. This initiative will boost economic resilience by building capability in high value areas of competitive advantage across the battery value chain. Additionally, the $20.3 million Building Future Battery Capabilities measure will build future battery industry skills and capabilities and strengthen national collaboration. These programs build on existing efforts through New Energy Apprenticeships, Critical Minerals Trade Enhancement Initiative and more.

The strategy is part of the Australian Government’s Future Made in Australia agenda to secure our future prosperity amid the global energy transition and industrial transformation. The 5 strategic battery priorities outlined in the strategy incentivise investment in priority industries. These include clean energy technology manufacturing such as battery manufacturing to create secure jobs, bolster domestic capability and ensure economic resilience and security.

The strategy will support Australia’s battery industry to operate on a more level playing field with its international competitors and support it to move up the battery value chain. This will allow us to meet part of our domestic battery needs, provide greater domestic supply security and create export opportunities that will diversify the global battery market.