Latest developments

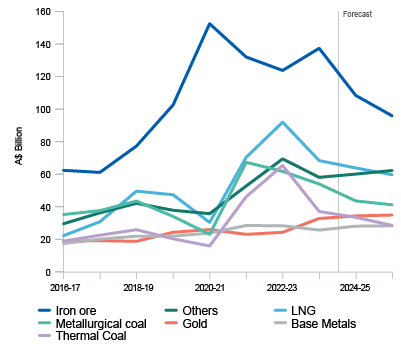

Australian resources and energy exports are forecast to continue to ease after the record peak seen in 2022–23.

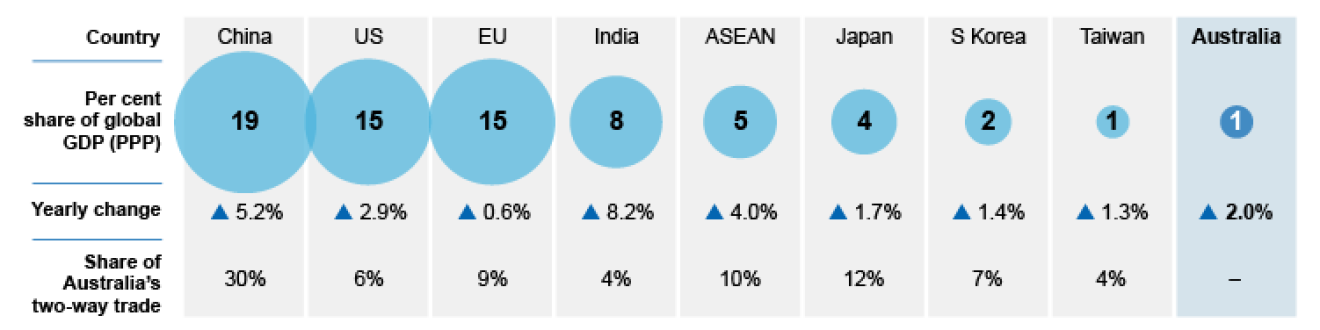

- The near-term outlook for Australian resource and energy commodity exports is little changed in net terms since the September 2024 REQ. Steady world economic growth (and hence commodity demand) are forecast in 2025 and 2026.

- Australia’s resource and energy exports are forecast to fall to $372 billion in 2024–25 from $415 billion in 2023–24 as commodity prices settle at lower levels than in 2022–23. Export earnings are expected to decline to $351 billion in 2025–26.

- Strong demand has seen the gold price hit a new record high. Alumina prices have surged and iron ore exploration expenditure in Australia is at the highest level in a decade.