Latest developments

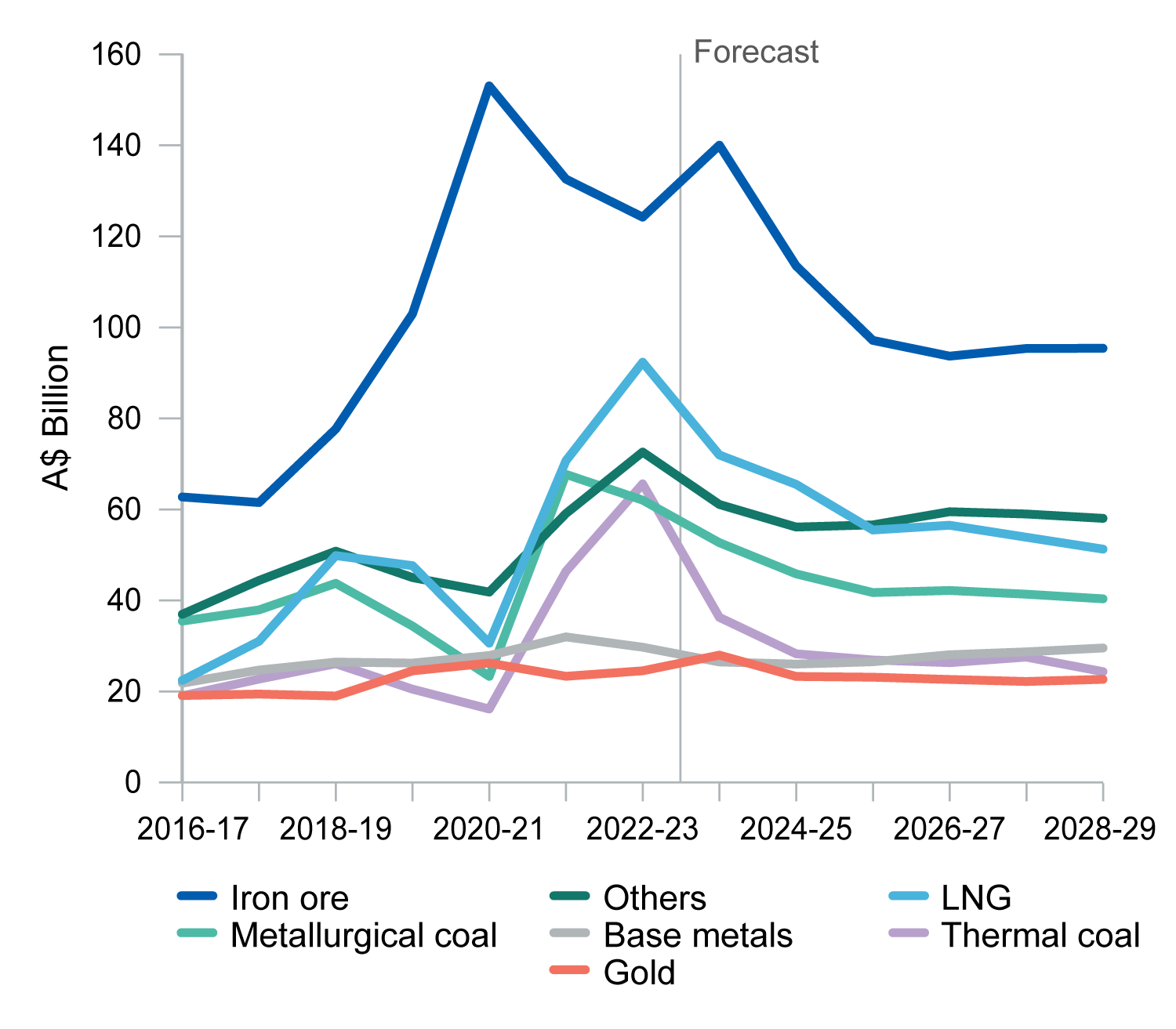

Australian resources and energy exports are set to ease after the extraordinary surge of 2022–23.

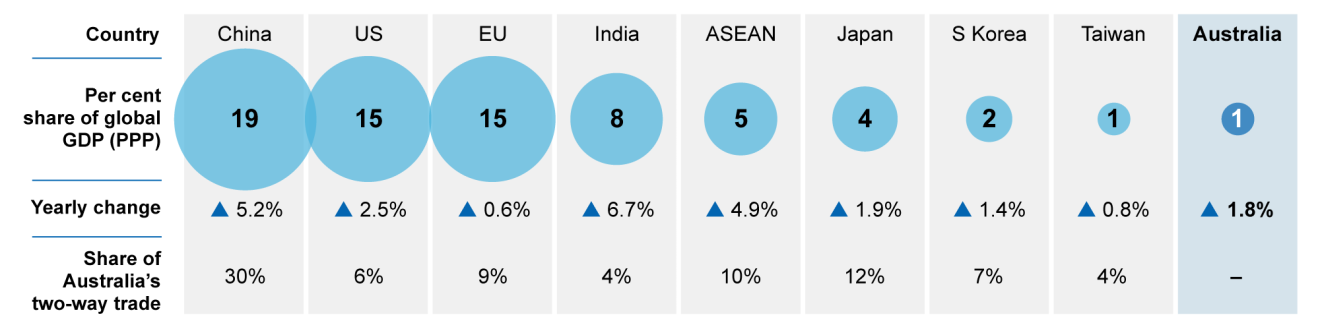

- In net terms, the near-term outlook for Australian resource and energy commodity exports has improved slightly since the December 2023 edition of the REQ. Central banks have managed inflation without shrinking GDP in major economies. World economic growth is expected to improve in 2025 once restrictive monetary policy eases. The global energy transition along with firm growth in China and India will maintain demand for minerals over the rest of the outlook period.

- The latest forecast is for weak growth in world demand and rising world commodity supply to reduce Australia’s resource and energy exports from $466 billion in 2022–23 to $417 billion in 2023–24. In 2024–25, a further decline is likely, as commodity prices fall and the AUD/USD lifts. Further out, lower bulk commodity prices will impact export earnings.

- Further falls in nickel and lithium prices have been observed with higher supply than demand. Weakness in the real estate sector in China has softened iron ore prices.