Australians have great ideas – both from our world class research and from traditional Australian ingenuity. We don’t always make the most of those ideas, missing the opportunity to transform them into new businesses and new jobs.

We need a greater emphasis on celebrating success rather than penalising failure. This takes a cultural shift to encourage more Australians and businesses to take a risk on a smart idea. We need to leave behind the fear of failure, and challenge each other to be more ambitious.

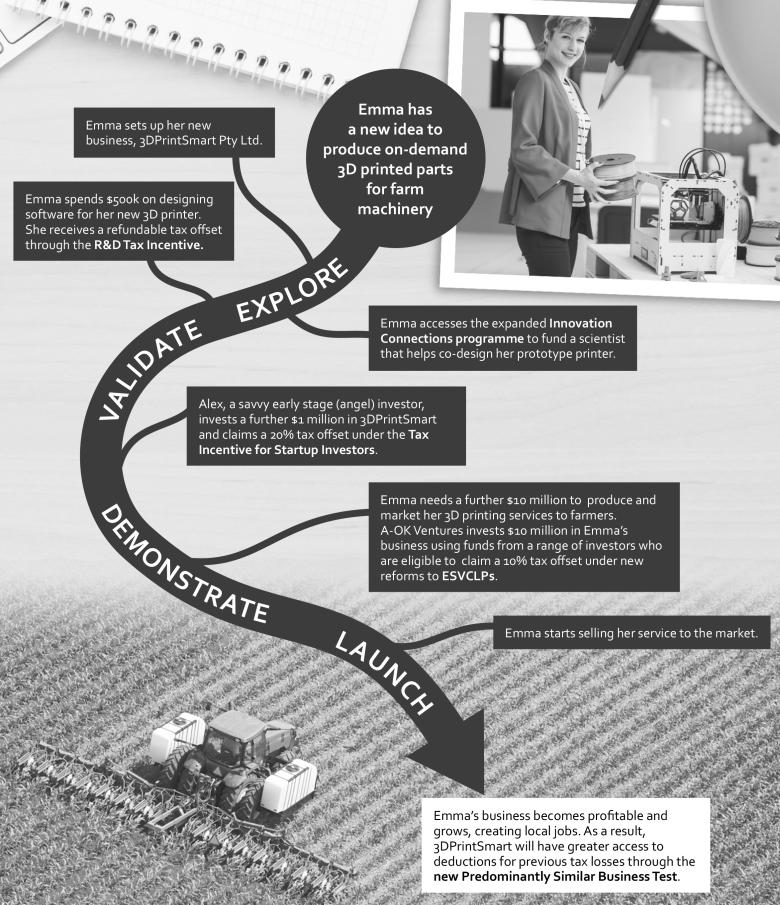

We need to improve the availability of finance for our innovative startups. The period between initial funding to when a startup begins generating revenue is known as the ‘valley of death’. During this time additional financing is usually scarce, leaving the business vulnerable to cash flow requirements.

Around 4,500 startups miss out on equity finance each year and access to additional finance is one of the main barriers to growth that startups face. Innovative businesses that don’t have a track record and that are not following a proven methodology can find it particularly difficult to raise finance from traditional sources. Early stage investors, whether individuals or companies, can play a key role, both in providing direct investments and in contributing their business experience.

The venture capital industry is gaining momentum in Australia, with over $600 million raised or planned since 30 June 2015. Confidence in early stage startup activity is strong, but this is primarily concentrated in the technology sector. It’s important that we build on this momentum, improving funding for promising projects right across the economy.

The measures in this package will address this funding gap and help ensure a steady flow of investment opportunities through to later stage venture capital investors.

New initiatives

We are aligning our tax system and business laws with a culture of entrepreneurship and innovation.

- We will provide new tax breaks for early stage investors in innovative startups. Investors will receive a 20% non-refundable tax offset based on the amount of their investment, as well as a capital gains tax exemption. This scheme is based on the successful Seed Enterprise Investment Scheme in the United Kingdom, which has resulted in over $500 million in funding to almost 2,900 companies in its first two years.

- We will build on the recent momentum in venture capital investment in Australia including by introducing a 10% non-refundable tax offset for capital invested in new Early Stage Venture Capital Limited Partnerships (ESVCLPs), and increasing the cap on committed capital from $100 million to $200 million for new ESVCLPs.

- We will relax the ‘same business test’ that denies tax losses if a company changes its business activities, and introduce a more flexible ‘predominantly similar business test’. This will allow a startup to bring in an equity partner and secure new business opportunities without worrying about tax penalties.

- We will remove rules that limit depreciation deductions for some intangible assets (like patents) to a statutory life and instead allow them to be depreciated over their economic life as occurs for other assets.

- We will also reform our insolvency laws, which currently put too much focus on penalising and stigmatising business failure. The Government understands that sometimes entrepreneurs will fail several times before they succeed – and will usually learn more from failure than from success. Accordingly, we will:

- reduce the default bankruptcy period from three years to one year;

- introduce a ‘safe harbour’ for directors from personal liability for insolvent trading if they appoint a professional restructuring adviser to develop a plan to turnaround a company in financial difficulty; and

- ban ‘ipso facto’ contractual clauses that allow an agreement to be terminated solely due to an insolvency event, if a company is undertaking a restructure.

We will back high potential ideas with capital to help ensure they stay and grow in Australia.

- We will establish a new $200 million CSIRO Innovation Fund to co-invest in new spin-off companies and existing startups that will develop technology from CSIRO and other publicly funded research agencies and universities.

- We will establish a new Biomedical Translation Fund to co-invest $250 million with the private sector to increase the capital available for commercialising medical research within Australia and help ensure that our deep strengths in this area are leveraged to drive future growth.

We will also back small businesses and startups to help them establish and grow.

Over the decade from 2001 to 2011, SMEs aged less than five years employed only around 15% of the Australian workforce, but made the highest contribution (40%) to net job creation in Australia.

- We will support incubators which play a crucial role in the innovation ecosystem to ensure startups have access to the resources, knowledge and networks necessary to transform their ideas into globally scalable new businesses.

- To make it easier for promising businesses to hire and retain top staff, we will make existing employee share scheme (ESS) rules more user friendly. The new rules will allow companies to offer shares to their employees without having to reveal commercially sensitive information to their competitors. These changes build on the recent reforms to ESS, which included deferring the taxing point for employees and introducing an additional concession for those working in startup companies.

Track record

The government has a strong track record in promoting an entrepreneurial culture and supporting businesses.

We have introduced generous tax concessions for startups who reward their staff through employee share schemes, allowing them to compete with established companies and to attract the best talent from overseas.

We have also introduced legislation to allow new companies to attract financing through crowd-sourced equity. The scheme allows companies to raise up to $5 million per annum through this mechanism, which compares favourably to other countries such as the United States (US$1 million p.a.) and New Zealand (NZ$2 million p.a.).

Australia’s successful startups

We need to support new businesses that disrupt and challenge the status quo – creating new opportunities and new jobs like SEEK and Atlassian.

For example, the jobseeking website SEEK was founded as a startup in 1997. SEEK is now one of Australia’s top 100 companies with market capitalisation of over $4 billion and over 500 employees in Australia and New Zealand alone.

In 2001, Mike Cannon-Brookes and Scott Farquhar founded Atlassian on a $10,000 credit card. Today the enterprise software company is a multinational valued at over US$3 billion and employs over 750 people.