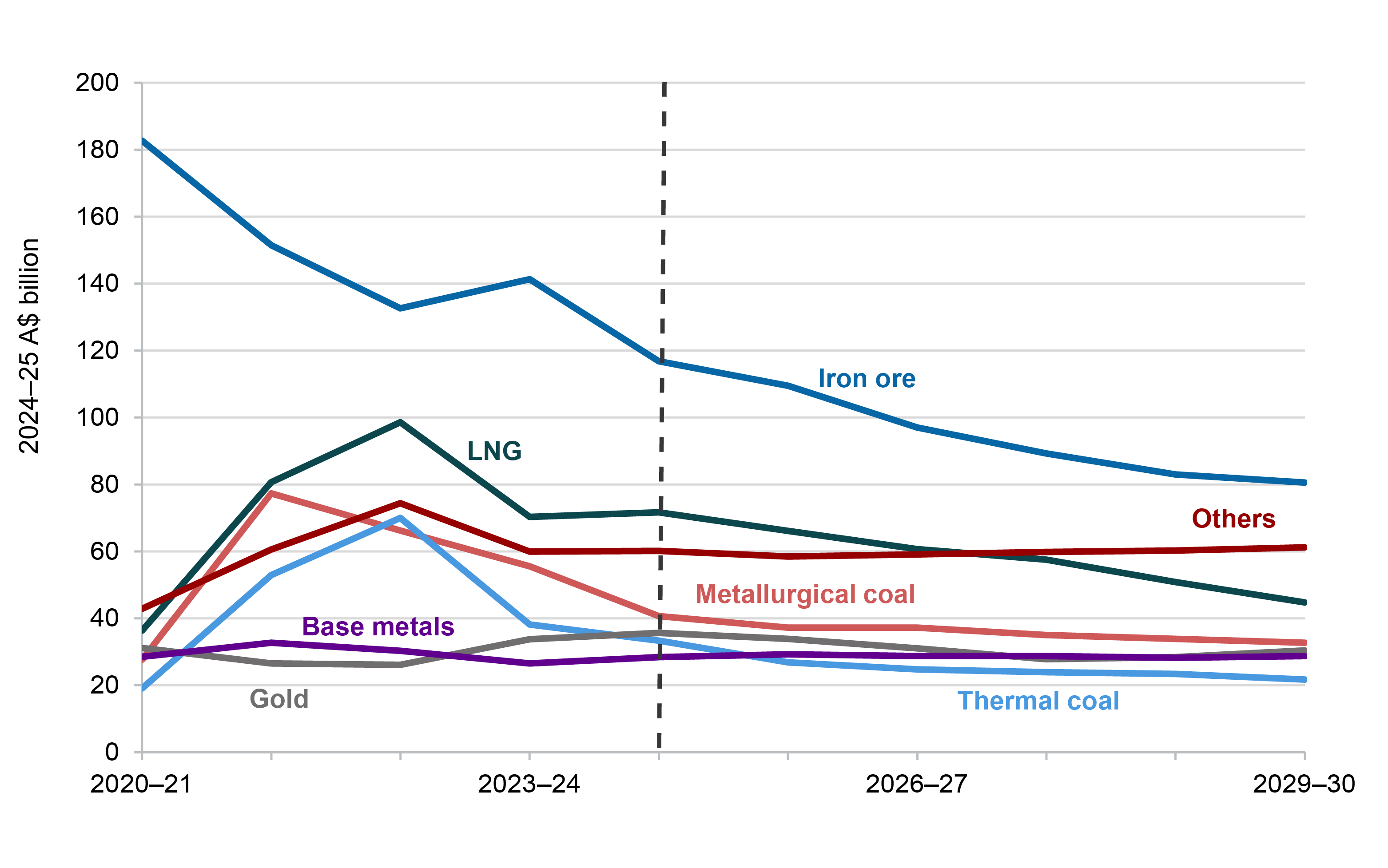

Australian resource and energy commodity exports are expected to fall to $387 billion in 2024–25 from $415 billion in 2023–24. Modest further falls are likely over the 5-year outlook period, with exports steadying at about $343 billion (or $300 billion in real terms) as the decade ends. Influences will include:

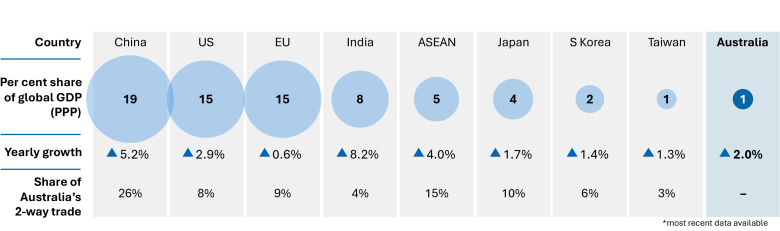

- Modest global economic growth is expected over the outlook period, as lower inflation allows some central banks to make further small cuts in official interest rates. Trade actions and retaliatory measures will likely detract from global growth and may further geopolitical tensions.

- Trade actions and retaliatory measures will also shape supply chains, which were already impacted by policy efforts to boost resilience in the wake of COVID-induced disruptions. Continued relocation of global manufacturing capacity will likely worsen global overcapacity.

- The energy transition will continue, although the pace remains uncertain. Policy plays a role, but technology (adoption rates and innovation) will remain the key determinant of commodity demand.