A cost-competitive and sustainable Australian offshore decommissioning industry requires access to appropriate vessels and infrastructure (CSIRO 2024a).

Australian offshore oil and gas projects – while not large in number in the global context – encompass a wide array of facility types. This diversity of structure size and composition adds complexity to decommissioning – not just offshore, but once material comes onshore for further processing.

Downstream of direct offshore decommissioning activities sits an array of infrastructure and capabilities that are used for the onshore parts of the decommissioning activity. This includes physical infrastructure in and around ports. It includes the shipping channels and turning basins for the types of vessels bringing material to shore. It also includes recycling capabilities and the ability to safely handle, store, and dispose of a range of waste streams.

There are 5 main attributes for ports needed for decommissioning:

- proximity to offshore infrastructure to be decommissioned

- berth types

- laydown area availability near the port

- proximity and impact to communities

- proximity to material recycling and end-of-life handling facilities (KPMG 2023).

The needed infrastructure at ports depends on the removal method and whether infrastructure comes onshore in small or large pieces. Decommissioning vessels vary in beam, length and draft, and have different berthing needs. This means there is not a one-size-fits-all approach that will be suitable to every company undertaking decommissioning activities.

The choice of port is determined by the needs of offshore oil and gas operators, contractors and port operators who will undertake the decommissioning activity. They will make their decisions based on a combination of regulatory, economic, physical and social considerations (KPMG 2023). Port access may also be constrained by competition from existing and emerging uses. Existing mining and offshore oil and gas operational activities, export opportunities, defence, civil engineering projects and potential offshore wind projects all compete for port access.

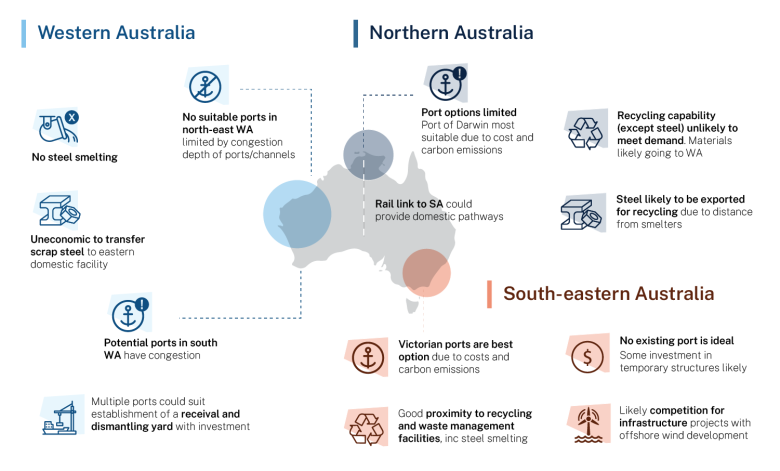

Australia has existing ports infrastructure in areas adjacent to the main offshore oil and gas production areas in the north-west and south-east of Australia. Research commissioned to support this roadmap evaluated the port infrastructure needs for decommissioning activities in the south-east of Australia and offshore Northern Territory. It considered these needs against ports in the region (KPMG 2023). CODA has commissioned similar analysis on infrastructure offshore Western Australia (CODA 2024b). Both analyses found that no port has all the attributes needed to handle all the types and size of materials from offshore decommissioning. However, there are sufficient ports to host many decommissioning activities without substantial modifications.

Ports that are unsuitable to accept large vessels may need modifications for a ‘piece-small’ removal approach. For example, where offshore facilities are deconstructed at sea with small modules transported to relevant ports (KPMG 2023). Temporary dismantling facilities at decommissioning ports could improve efficiency in processing, transport and export of decommissioned materials. Where decommissioning vessels cannot approach a port, barges can also play a supporting role by transferring materials (KPMG 2023). It may also be viable for temporary or semi-permanent facilities at existing ports to fill some of the gaps. The exact needs for additional or modified port facilities must be determined on a case-by-case basis in conjunction with decisions on the removal of infrastructure and how it will be handled onshore (KPMG 2023).

Access to heavy lift vessels will also be critical. On current availability, decommissioning planning needs to consider lead times of up to 3 years as these vessels work all over the world. This underscores the need for industry and governments to work together far in advance to support future decommissioning activities (CSIRO 2024a).

There is a role for government in working with industry to help coordinate planned investment activities, including managing competing demands on infrastructure. Coordinating planned activities, and encouraging collaboration across the industry, can help to create efficiencies and reduce costs to industry in the aggregate. As seen with the UK’s NSTA, a coordination mechanism can help to generate investment and efficiencies. The NSTA has supported the UK’s offshore industry in cost-effective decommissioning, having delivered £15 billion worth of savings to the overall estimate for remaining infrastructure between 2017 and 2022. It has also facilitated 95% of decommissioning contracts being awarded to UK-based organisations between April 2023 and March 2024 (NSTA 2024).