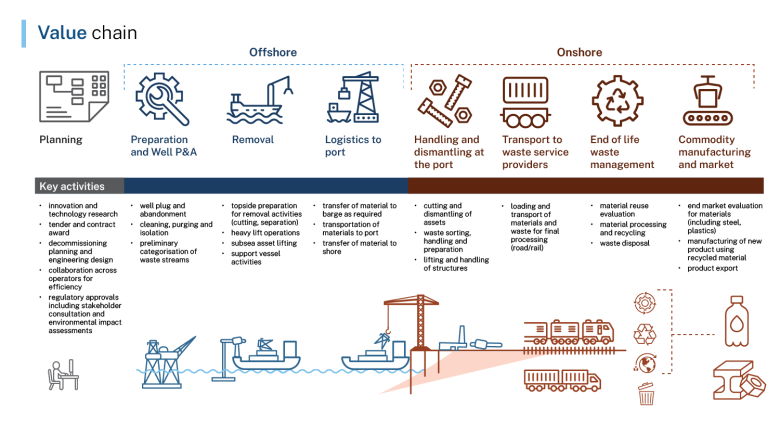

Australia’s decommissioning value chain spans both onshore and offshore activities. There are a wide range of different businesses involved in the many separate activities that make up the decommissioning value chain, including:

- planning, preparing, contracting, and securing the necessary approvals

- securely plugging oil and gas wells and removing hundreds of kilometres of pipelines and flow lines from the sea floor

- dismantling steel structures, with large production decks, embedded in the sea floor and removing floating oil and gas producing facilities and their anchors

- transporting these materials to ports and dismantling yards, recycling steel, plastics and other materials, and sorting, treating, and safely disposing of waste materials.