Workforce

Australia has a skilled domestic workforce with extensive experience in the oil and gas industry. Research commissioned for this roadmap demonstrates the majority of the existing workforce can re deploy and re-skill for decommissioning projects to support Australia’s energy transition (CSIRO 2024a). However, it may be difficult to attract and keep a workforce due to competition with an emerging renewables sector (KPMG 2023).

Vessels

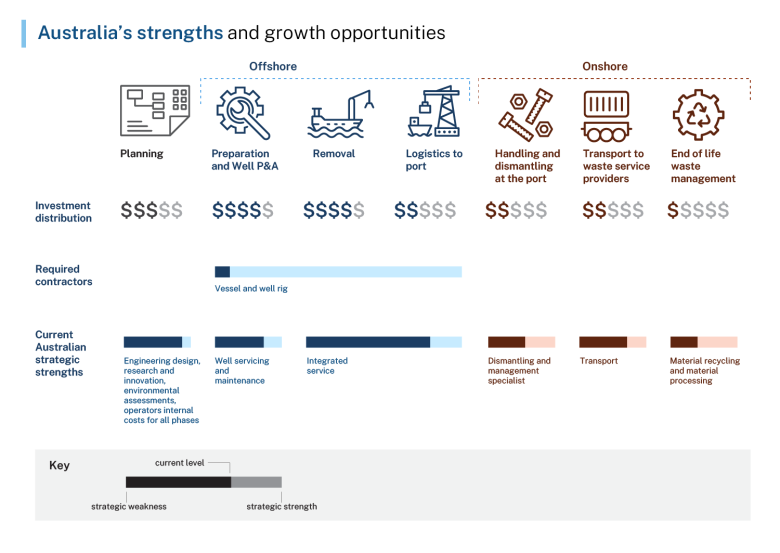

Australia is distant from most global decommissioning markets where there are vessels and specialty equipment (KPMG 2023). Australia does not host the vessels for doing heavy decommissioning offshore and must import them. Local availability for heavy lift and specialist vessels is unlikely to be a strategic opportunity and can be best managed through importation and collaboration. However, there are opportunities for the domestic workforce to crew and support these activities (CSIRO 2024a). Our limited market for offshore decommissioning vessels at present makes it costly to bring these assets into Australian waters for uncoordinated campaigns or single decommissioning projects.

Infrastructure

Offshore decommissioning in Australia will be an inherently regional activity, with work clustered in south-east and north-west Australia. The south-east of Australia will also host significant offshore wind generation in future. Constructing offshore renewables could overlap with decommissioning and increase competition for infrastructure and capability, including ports, which requires careful management and coordination. There is no port perfect for all decommissioning activity types, which may necessitate modifications in future to service decommissioning demand.

Waste management and recycling

Australia has a domestic recycling industry that can play a major role in the waste management phase of offshore decommissioning. It also has a mature concrete recycling market that services the construction and demolition industries.

Australia’s recycling and waste management industries are generally well placed to manage decommissioned materials appropriately. However, there are some critical knowledge gaps that, if addressed, could improve outcomes. This includes innovation on the impact of contaminants on the environment and ecosystems, possibilities to develop new recycling pathways and technologies, and more efficient cleaning and waste management processes.

Reuse and repurposing of materials supports a circular economy, minimising carbon emissions. It can also supply materials to connected industries, for example, construction of offshore renewable energy infrastructure or use in other civil and construction projects.

Research capabilities

Australia has innovative products and technologies that can create an opportunity for global exports to other decommissioning markets. There is potential for Australia to be a significant contributor to the global decommissioning market by creating new innovative products and services (KPMG 2023). The offshore oil and gas industry is an active adopter of digital and emerging technologies that can reduce environmental impact and drive efficiencies. Industry is driving commercially viable innovations at early stages of the value chain. However, there is an opportunity for further innovation downstream in areas such as waste management, recycling, and environmental outcomes (ATSE 2024).